How to Maintain Your Fun Lifestyle While Planning for Retirement

Imagine a retirement filled with laughter, adventure, and lifelong memories, all while ensuring financial stability and peace of mind. Sounds too good to be true? We’re here to tell you that it’s not only possible but also achievable with careful planning, retirement coaching, and a balanced approach.

This blog post will guide you through 14 essential steps, each designed to help you maintain your fun lifestyle while preparing for a comfortable way of living in retirement. So, let’s embark on this exciting journey to create a golden retirement that you’ll cherish for years to come.

Quick Summary

- Create a comprehensive retirement plan with the help of a financial planner

- Prioritize health and wellness, develop multiple sources of income, pursue hobbies and interests

- Invest in experiences over material possessions. Stay informed about taxes/regulations. Create a support network

Create a Comprehensive Retirement Plan

A happy retirement begins with a comprehensive plan that reflects your financial and lifestyle goals. With a well-crafted retirement plan in place, you can approach your golden years with confidence and ease. The key is to start planning as early as possible, considering factors such as:

- longevity

- inflation rates

- rates of return

- health costs

- spending

- income

- mortgage rates

Regardless of whether you retire at the traditional retirement age or earlier, working with a certified financial planner to help with your retirement planning can make the major transition to retirement less daunting by providing invaluable assistance in making the numerous financial and life decisions involved.

With a solid retirement plan, you’ll be well on your way to enjoying a fulfilling retirement filled with mental health benefits, physical activity, and well-being through proper financial planning.

Prioritize Health and Wellness

Good health, including physical health, is the foundation of a happy retirement. Prioritizing your physical and mental health in retirement is essential for maintaining a joyful and healthy lifestyle.

The National Institute on Aging advocates that elderly adults should engage in various activities to keep healthy. Activities could include visiting local museums with family, for instance, or joining a book or film club.

Exercise and a healthy diet play a crucial role in reducing the risk of developing heart disease and certain health conditions, increasing energy levels, boosting your immune system, and improving your mood. Embracing an optimistic attitude in retirement can also contribute to a longer life, a lower risk of developing cardiovascular disease, and a more positive outlook on life.

Develop Multiple Sources of Income

Diversifying your income sources is a vital aspect of personal finance in retirement. Optimizing your income through investments, part-time work, and passive income can help ensure that you have enough money to maintain a comfortable lifestyle and retire happy.

Let’s explore these income sources in more detail in the following subsections.

Investments

Engaging a financial advisor can be a game-changer when it comes to creating an investment plan for retirement. With their expertise, retirees should focus on investing for income as well as growth while staying physically active to maintain a healthy lifestyle.

An investment policy statement can be a valuable tool, outlining a roadmap for achieving your investment goals, providing guidance on adjusting your plans, and offering options when things don’t go as planned.

Having an investment policy statement enables you to make wiser decisions about your money, ensuring that your investments align with your financial goals and risk tolerance.

By staying informed and working closely with a financial advisor, you can make the most of your investments and secure a comfortable retirement.

Part-time work

Part-time work in retirement can be a fulfilling and financially rewarding experience. Exciting options such as consulting work or pursuing a business idea can help you stay active and engaged in your golden years.

Phased retirement, an excellent opportunity to gradually scale back your professional obligations, can provide a smooth transition to full retirement while offering a temporary financial boost by supplementing your retirement income.

Even if your employer doesn’t offer phased retirement, there are other opportunities to reap similar benefits, such as taking up a part-time job or volunteering. Working after retirement not only offers financial security but also a sense of fulfillment and purpose.

Passive income

Passive income, generated with minimal effort to maintain, is another excellent way to support your desired lifestyle in retirement. Some examples of passive income sources include:

- Investments

- Rental properties

- Dividend-paying stocks

- Royalties from creative works

- Affiliate marketing

- Online courses or digital products

These income sources can provide a steady stream of income without the need for full-time work.

The opportunities with passive income include the potential for increased capital, reduced expenses, and favorable changes in the market. By generating passive income, you can bolster your retirement savings and maintain your lifestyle with minimal effort.

Cultivate Strong Social Relationships

Strong social relationships are essential for a happy retirement, helping to combat loneliness, improve mental health, and enhance overall well-being.

Staying connected with loved ones can be achieved through social events, such as game nights or weekly outings to movies or museums, as well as through technology, like Zoom and Google Hangouts. Additionally, understanding and managing one’s social security benefits can contribute to a more secure and enjoyable retirement.

Owning a pet, spending time with grandchildren, and having friends in retirement can all bring immense joy and contribute to a longer, healthier life.

Prioritizing social relationships and connecting with people of all ages can have both physical benefits and a profound impact on your happiness and life satisfaction in retirement.

Pursue Hobbies and Interests

Staying engaged and mentally sharp in retirement is vital, and pursuing hobbies and interests can help you achieve just that. Here are some exciting hobbies to explore in retirement:

- Learning an instrument

- Learning a second language

- Traveling

- Playing a sport

Do you want to make new friends? In retirement, you can make it happen by taking up a new hobby, which can also help you stay active and make the most of your free time. Embracing new interests and shaking things up with spontaneous activities can bring a fresh sense of excitement and adventure to your retirement years.

Practice Mindfulness and Gratitude

Practicing mindfulness and gratitude can greatly enhance your mental health, reduce stress, and increase overall happiness in retirement. One rewarding way to cultivate gratitude is by writing in a gratitude journal and, taking a few minutes each day to note the things you are grateful for.

Writing down our feelings of gratitude can be hugely beneficial for our health. From increased self-esteem and better sleep to lower blood pressure and improved heart health – the advantages are vast. Mindfulness meditation, which encourages non-judgmental awareness of the present moment, can also be a powerful tool to improve mental well-being and find serenity in retirement.

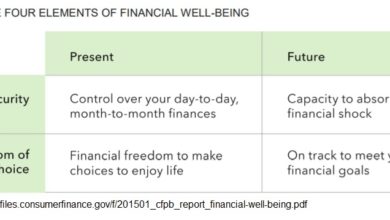

Seek Professional Financial Advice

Ensuring a secure and fulfilling retirement often requires the guidance of a professional financial advisor. By seeking expert advice, you can optimize your retirement plan and ensure you’re on track to meet your financial goals.

With a financial advisor’s assistance, you can develop a solid foundation for your retirement planning and make the most of your hard-earned savings. Don’t feel overwhelmed; this is what a financial advisor is here for, to help you navigate these waters.

Focus on Experiences Over Material Possessions

We understand that your hard-earned material possessions are important to you, but focusing on experiences over material possessions in retirement can create lasting memories and help prioritize what truly matters.

Money can be used to spend money on time and invest in experiences, both of which can lead to a fulfilling retirement.

Setting your own retirement goals instead of trying to keep up with the Joneses can help you feel more secure in your retirement planning and give you a greater sense of control. Some ways to prioritize experiences over material possessions in retirement include:

- Traveling to new destinations

- Trying new hobbies or activities

- Spending quality time with loved ones

- Volunteering or giving back to your community

Emphasizing experiences over material possessions can bring joy and fulfillment, enriching your retirement years and allowing you to create a legacy of unforgettable memories.

Optimize Housing and Living Arrangements

Optimizing your housing and living arrangements is crucial for a successful retirement plan. Creative ideas for reducing housing costs in retirement include downsizing, relocating, or considering alternative options.

Relocating for retirement can create more free time, offer the chance to downsize, and many other benefits that bring retirees into an environment of like-minded people. Moreover, having a mortgage paid off or almost paid off before retirement greatly enhances the chances of enjoying a comfortable and worry-free retirement.

Maintain a Balanced Budget

Maintaining a balanced budget is crucial to ensuring your retirement savings last and avoiding financial stress. The “spend safely in retirement strategy,” recommended by the Stanford Center on Longevity and the Society of Actuaries, can help you make the most of your retirement income.

Saving more than you spend is the key to successful personal finance, especially for retirement. It’s important to keep a budget and track your expenses so you know where your money is going.

Making accurate predictions of retirement expenses and adhering to a balanced budget can ensure financial stability and security in retirement.

Consider Long-Term Care Planning

Next to everything we’ve mentioned, long-term care planning is also an essential aspect of retirement preparation, ensuring you are ready for any healthcare needs and safeguarding your financial security. Nearly half of the seniors turning 65 today will require long-term care services. This is an opportunity that potentially lies ahead.

Exploring alternatives to long-term care insurance and re-evaluating your supplemental Medicare coverage can maximize your savings and enhance your benefits. By considering long-term health care costs and planning, you can be well-prepared for future healthcare needs and protect your financial well-being in retirement.

Stay Informed About Taxes and Regulations

Staying informed about taxes and regulations is vital to maximizing your retirement savings and taking advantage of available tax benefits. There are 17 helpful tips for retirement taxes provided in the source section, which can help you minimize your tax burden and make the most of your retirement income.

Understanding taxes and regulations, such as the Income-Related Monthly Adjustment Amount (IRMAA), can help you recognize and benefit from favorable tax opportunities. By staying informed and adopting tax-minimization strategies, you can optimize your retirement savings and secure a comfortable retirement.

Embrace Learning and Personal Growth

Embracing learning and personal growth in retirement can help you stay mentally sharp and engaged, allowing you to enjoy a fulfilling retirement. Retirees can look forward to taking classes, attending workshops, and discovering new interests to keep learning and growing.

Staying curious in retirement can lead to continued learning and mental stimulation, which can be highly beneficial. By embracing new challenges and constantly seeking self-improvement, you can enhance your cognitive abilities and stay mentally engaged in your golden years.

Create a Support Network

Creating a support network of friends, family members, and professionals can help you navigate the challenges and joys of retirement. Discussing financial and retirement plans with friends and family can inspire more beneficial habits and decisions.

Volunteering provides retirees with the opportunity to:

- Make a positive impact

- Create meaningful connections

- Help others

- Contribute to personal well-being and satisfaction

- Enhance retirement experience

- Provide a sense of belonging and purpose

Plan for the Unexpected

Planning for the unexpected is invaluable in retirement, as it can help guarantee a secure and enjoyable retirement. Proactive steps to prepare for potential climate-related disasters, health issues, and financial challenges include having an emergency fund, insurance, and contingency plans in place.

By planning for the unexpected, you can ensure that your retirement is well-prepared for any unforeseen events, allowing you to focus on enjoying your golden years with peace of mind.

Full Summary

Maintaining a fun lifestyle while planning for retirement is achievable with careful planning and a balanced approach that considers both financial and personal aspects. By following these 14 essential steps, you can create a retirement filled with laughter, adventure, and lifelong memories, all while ensuring financial stability and peace of mind.

As you embark on your retirement journey, remember to cherish each moment, embrace new experiences, and prioritize what truly matters. With a solid plan in place, you can confidently step into your golden years, ready to make the most of the exciting adventures that await.

To discover how the Institute of Financial Wellness can support you in achieving your financial goals, we invite you to request a complimentary Custom Retirement Roadmap. This personalized plan will help you map out a clear path to your retirement goals and equip you with the tools and knowledge necessary to make informed financial decisions. Contact us today to get started on your journey toward financial freedom and success.

Frequently Asked Questions

How much money do you need to live comfortably in retirement?

By following the 80% rule and the recommendation to save 5-8x your combined salary by age 50-60, you need at least $1.27 million to live comfortably in retirement.

This amount is a daunting figure, but it is achievable with the right plan. Start by creating a budget and tracking your expenses. This will help you identify areas where you can cut back and save more. Additionally, consider investing in stocks, bonds, and other investments to make enough income to help grow.

How do I live a comfortable retirement?

To live a comfortable retirement, aim to save close to $1 million or 80-90% of your yearly income before quitting work, and try to save 12 times your annual salary.

With this advice in mind, you’ll be well on your way to enjoying your retirement years!

What is the average 401k balance for a 65-year-old?

The average 401(k) balance for a 65-year-old is $279,997.

How many Americans have $1,000,000 saved for retirement?

Only around 10% of retirees have $1 million or more in retirement savings, with the majority having far less. That means fewer people are living a comfortable lifestyle in retirement.

How can I make my retirement life happy?

Maintain strong and active social life connections, have a complete retirement plan, stay healthy, explore and engage in hobbies, travel and visit places, and keep your finances organized to ensure a happy and meaningful retirement life.

Strong social connections are important for a meaningful retirement life. It is essential to have a retirement plan that covers all your needs and wants. Staying healthy is essential for a happy retirement life. Exploring and engaging in hobbies can help keep you active and engaged. Traveling and visiting.

After 18 years as President and Founder of TheaterMania and OvationTix, Darren is excited to be on a new journey as the President and Co-Founder of The Institute of Financial Wellness. (The IFW)

For consumers, The IFW provides financial education, resources, and services that help people live their best life.

For Financial Professionals, The IFW provides proven sales and marketing systems, state-of-the-art technology, training, and support to financial professionals nationwide. The IFW helps financial professionals grow their practices to the next level! IFW Certified Financial Professionals are an elite group of professionals that, together with the IFW, help people succeed financially and live their best lives.