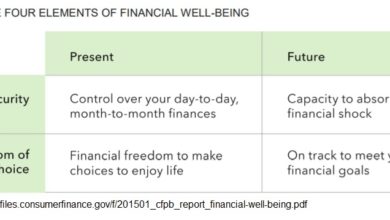

Unlock Steady Income: Crafting a Comfortable Retirement with Annuities

Imagine you’ve just retired, sipping your morning coffee and pondering the exciting adventures ahead. But then, a thought crosses your mind: “Will I have enough income to sustain my lifestyle throughout retirement?”

A steady income during retirement is crucial, and one effective way to achieve this is through annuities.

In an era where economic uncertainties loom and life expectancies rise, annuities emerge as the smart, reliable backbone of a retirement plan that lets you enjoy your well-earned rest without financial fret.

“If you observe, people always live forever when there is an annuity to be paid them.” – Jane Austen

So, why settle for sleepless nights worrying about market fluctuations when you can bask in the peace of mind that annuities provide? Embrace annuities and turn your retirement dreams into your everyday reality.

Key Takeaways

- Retirement annuities provide a steady income and require consideration of type, provider reputation & financial stability, and contract terms.

- Factors to consider when choosing an annuity include fees, penalties for early cancellation & individual circumstances.

- Research the top 5 retirement annuity providers based on ratings/features. Evaluate factors such as fees/charges before selecting one that fits your needs.

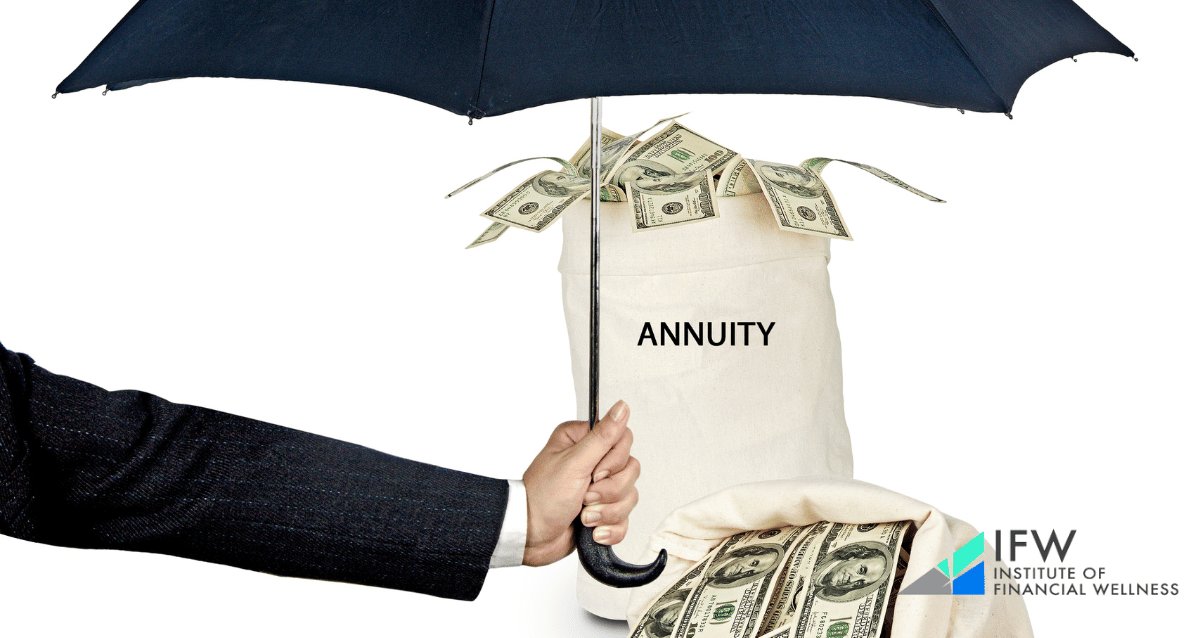

Understanding Retirement Annuities

For a secure and worry-free retirement, annuity products from insurance companies can be very useful. These are investments that guarantee income in return – without worrying about the taxes that might accumulate along with growth. The types of annuities include deferred ones, immediate options as well as fixed-income contracts.

All are issued by reliable sources for customer assurance. It is important to choose carefully when selecting one such product based on factors like reputation and financial stability related to the provider or company offering it, plus other key aspects concerning contract terms, etc. Knowledge of different kinds of income payment streams available will also aid decision-making leading up to choosing the right type of retirement plan beneficial long term.

Types of Annuities for Retirement

Individuals who desire a stable return should consider fixed annuities, as these provide guaranteed rates of interest. On the other hand, those looking for higher potential returns may opt to invest in variable annuities – which involve more short-term risk due to being linked with stock market performance.

For investors who want some level of assurance but also seek upside opportunities without major downside risks, indexed or fixed index annuities can be an ideal solution. They offer a mixture of stability and a chance at growth from markets while still offering protection through their fixed nature. Both types cater to different needs when it comes to retirement planning – Fixed and variable Annuities have distinct advantages that will influence your decision based on the financial goals/risk appetite you are comfortable with.

Nonetheless, annuities can help you beat inflation and can be a great income source during retirement.

Factors to Consider When Choosing a Retirement Annuity

Selecting a reliable life insurance company with sound financial stability is of great importance when choosing an annuity for retirement. Investigating the fees involved in each plan will also influence your overall returns. A qualified financial advisor can help you identify which option best suits your individual needs. It’s essential to pick the right provider from day one since severance penalties may be charged if cancellation occurs within several years after establishing contact with an annuity firm.

Top 5 Best Retirement Annuity Providers

In order to make a well-informed decision, we’ve researched the market and gathered information about the best 5 annuity providers. These top contenders have been determined based on factors such as customer satisfaction ratings, the financial stability of each company, and available products.

The upcoming sections offer brief insights into every provider that can help you in your final choice process.

Provider 1: Lincoln Financial Group

Lincoln Financial Group is a well-known insurance and financial services company that offers a wide range of products, such as life insurance, fixed annuities, variable annuities, and retirement plans. The company has been in existence for over a century and is headquartered in Philadelphia. Lincoln Financial Group is considered one of the best annuity providers in the industry and offers numerous annuity options to its customers.

Some of the annuities offered by Lincoln Financial Group include fixed index annuities, variable annuities, immediate annuities, and income annuities, designed to provide retirement income to individuals and help them fund their retirement accounts.

One of the key benefits of purchasing an annuity from Lincoln Financial Group is the guaranteed income stream it provides. An annuity owner can receive income payments for a set period or for life, depending on the type of annuity purchased.

Additionally, Lincoln Financial Group offers annuity products that come with lifetime income riders, which provide an additional layer of protection against market volatility and ensure a guaranteed income stream for the rest of an individual’s life. Furthermore, the company has a high customer satisfaction rating and a low NAIC complaint index score, which indicates that it has a good track record of providing quality products and services to its customers. Overall, Lincoln Financial Group is a reliable and trustworthy life insurance company that offers financial stability and peace of mind to its customers.

Provider 2: Nationwide

Nationwide is an insurance company with over 85 years of experience in retirement planning. The provider has a strong reputation for offering the best retirement annuity options for its members. They offer a wide range of annuities, including variable annuities, fixed annuities, fixed index annuities, and immediate annuities. This range of products gives customers the flexibility to choose an annuity that best suits their financial goals and needs.

One of the key advantages of Nationwide’s annuity products is that they offer guaranteed income and a lifetime income stream to the policyholders. The fixed-indexed annuities offered by Nationwide are particularly popular among customers due to their guaranteed income stream, which is tied to the market performance. This means that the customers can enjoy the benefits of market growth without the risk of losing money due to market volatility.

Additionally, Nationwide is known for its financial stability and customer satisfaction, as evidenced by its low NAIC complaint index score. Customers can trust Nationwide to provide them with a secure and reliable retirement income stream to fund their retirement accounts.

Provider 3: Allianz Life

Allianz Life is a subsidiary of the German financial services group Allianz SE. The company provides a range of retirement solutions, including annuities and life insurance policies. Among the annuities offered by Allianz Life, there are 7 fixed index annuities and 1 index variable annuity. Fixed index annuities are annuities that offer a guaranteed minimum interest rate and the potential for additional interest based on the performance of a market index.

These annuities can provide a level of protection against market volatility while still offering the potential for growth. Index variable annuities, on the other hand, offer the potential for greater returns but also involve more risk as their returns are tied to the performance of the stock market.

In addition to offering annuities, Allianz Life also provides life insurance policies.

Allianz Life offers a range of life insurance policies that can be customized to meet individual needs. These policies can provide a death benefit to beneficiaries as well as other benefits, such as accelerated death benefits and living benefits.

Provider 4: MassMutual

MassMutual, a well-known insurance and financial services company, has been providing insurance and retirement products, including life insurance, annuities, and IRAs, since 1851. The company has an impressive A++ rating from S&P Global Ratings, which speaks to its financial stability and strength. MassMutual offers a variety of annuity products, including one fixed annuity, one deferred income annuity, and one SPIA, or single premium immediate annuity.

This company’s fixed annuity offers a guaranteed interest rate for a set period, providing a steady rate of return. The deferred income annuity allows investors to defer income payments until a future date, providing a guaranteed income stream when they need it the most. The SPIA offers an immediate stream of income in exchange for a lump sum payment. Overall, MassMutual’s annuity products are designed to help individuals fund their retirement and provide peace of mind during their golden years.

Provider 5: Athene Holding Ltd.

Finally last but not least, Athene Holding Ltd. is a relatively newer player in the annuity industry, having been founded in 2008, but it has quickly become one of the largest providers in the country. The company offers a range of products, including 3 MYGAs, 2 RILAs, 6 Fixed Index, and 1 SPIA. Athene’s fixed annuities offer guaranteed interest rates for a specified period, providing a stable and predictable source of retirement income. The company’s fixed-indexed annuities provide the potential for higher returns by linking interest accumulation to the performance of an external market index. Athene’s RILAs also offer the potential for higher returns while providing downside protection, which makes them a good choice for those who want to balance growth and protection.

The company’s focus is on helping people achieve financial security and independence in retirement. Athene’s annuities offer a range of features and benefits, such as guaranteed income, fixed and variable interest rates, and death benefits. The company has a strong financial stability rating and is committed to providing excellent customer service, as evidenced by its high customer satisfaction ratings. Athene is a great choice for those looking for a reliable and stable provider of annuities to fund their retirement.

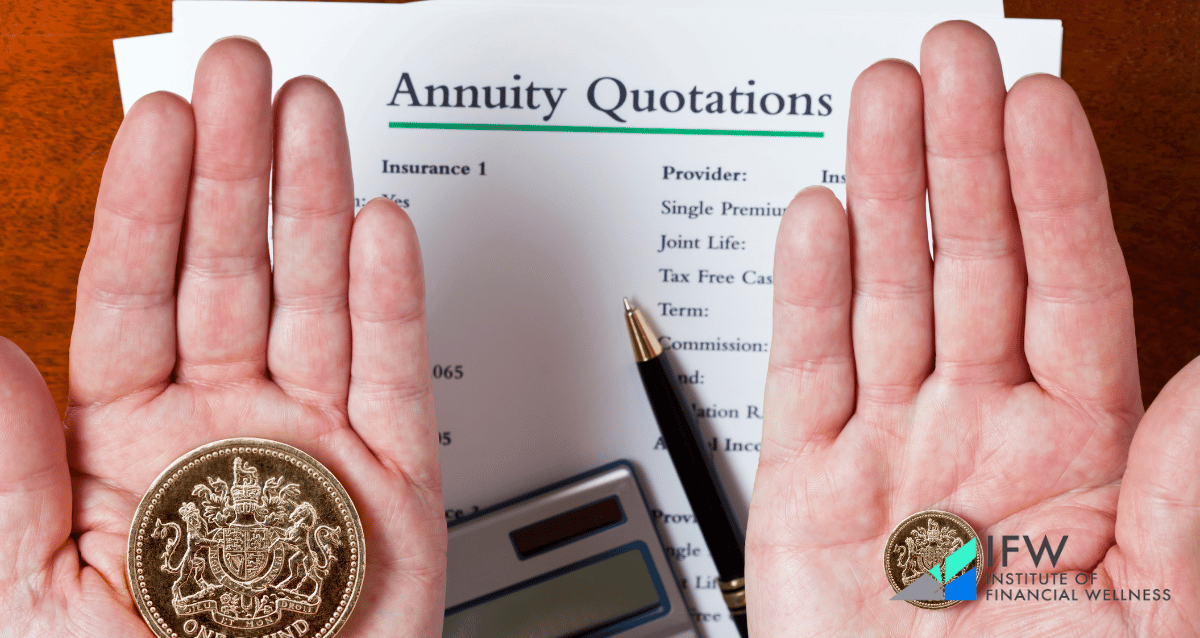

How to Evaluate Retirement Annuity Options

Making a decision on the best retirement annuity for your needs can be overwhelming. In order to make an educated choice, take into account components like costs and fees, guarantees/riders as well as payout options. We’ll analyze each of these factors in detail so you can pick out the most suitable plan for yourself.

When going through all possible choices, keep track of expenses such as commissions and other charges. Learn about available security features, including rider opportunities, along with existing withdrawal policies that come with various plans – this will ensure you get exactly what suits your situation!

Fees and Charges

When looking into an annuity for retirement, you should be aware of the various fees and charges that could potentially lower your returns. These might include administration/contract maintenance costs, commissions, mortality expenses, investment management fees, and surrender charges, which can range from 0.3% to 2%. Over time, these small amounts add up considerably, decreasing the income generated by the contract. Comparing different options when it comes to their associated fee structures is vital in getting the most out of one’s savings during retirement.

Pay attention to other potential hidden costs, such as transfer or administrative payments related to annuities. Reading through all contracts completely before making a decision on any type of plan is essential.

Guarantees and Riders

Annuity products have a number of guarantees and riders that can enhance the protection they provide. Retirement annuities are equipped with guaranteed lifetime income, principal/interest guarantee, as well as withdrawal and accumulation benefits for an added degree of stability when you’re planning your retirement funds.

Riders such as death benefit riders or cost-of-living ones make up some additional coverage not present in many standard annuity contracts but give more flexibility to customize your specific needs concerning future financial risks. An income annuity plan provides living benefit security while also giving access to extra services through their packages, like increased payouts after passing away – known commonly as the “death benefit”.

Overall, it is important to understand all the available options out there that help maximize returns on investments so one may enjoy peace of mind knowing their nest egg will carry them into a successful, secure retirement life!

Payout Options

When it comes to payout options, annuities offer several choices with different advantages for particular financial needs and objectives. These include fixed payments over a certain period, joint and survivor arrangements, and life-only plans. Lump sum payments provide one large amount at once (ideal for those who need an immediate infusion of funds) as well as the option of systematic withdrawals.

Life with period certainty is also available in order to guarantee income flow during a prearranged span, providing the stability that some customers might require or prefer. It’s important to understand these various possibilities when selecting an annuity tailored to your own specific requirements.

To ensure you have made the right choice according to your individual conditions, understanding all potential payout features is essential so that they can be evaluated correctly prior to making any decision regarding such investment instruments like this type of retirement product offering long-term security benefits alongside possible money growth opportunities while mitigating risks associated with other investment alternatives if carefully assessed ahead on time.

Tips for Purchasing a Retirement Annuity

Investing in a retirement annuity requires careful consideration, so it is wise to consult with a financial advisor who can explain the advantages and disadvantages of different types. Shopping around for various providers and products helps you find what best suits your particular needs. When poring over an annuity contract, watch out for hidden fees or charges, make sure there are sufficient guaranteed income provisions as well as investment options available, and be mindful of any surrender period requirements or penalties applied should one die prematurely – all these details need to be carefully read before signing on the dotted line! Through proper research and help from trusted advisors, making good choices will guarantee that retirees have peace of mind during their golden years.

Planning for Longevity and Inflation

When choosing a retirement annuity, two of the most important things to keep in mind are longevity and inflation. Longevity risk is when you might outlive your available savings or income sources, while inflation risks diminish payments’ purchasing power due to living costs rising. Strategies like laddering retirement assets for more stable returns, securing guaranteed monthly funds, and diversifying portfolios may help reduce these risks. Some annuities offer CPI-adjusted periodic amounts as protection against the impact of inflation on retired life earnings. Considering all this helps ensure safe financial support throughout one’s golden years.

The Institute of Financial Wellness

The Institute of Financial Wellness is an invaluable source for individuals seeking unbiased financial planning advice, particularly with regard to retirement annuities. Dedicated to providing the tools and resources that will enable people to live their most fulfilling lives financially speaking, The IFW provides customized solutions suited to varied life stages as well as individual needs.

Whether you’re just starting out on your journey into exploring retirement annuity options or need assistance refining a plan already in place, The IFW has everything needed to make savvy decisions and secure financial goals. With comprehensive educational materials plus specialized services made available at no cost — it’s clear why so many turn here first when looking for help managing finances responsibly!

Full Summary

By understanding the different types of annuities, assessing providers and factors in detail, and weighing longevity and inflation impacts carefully – all with regard to your financial objectives – you can make wise decisions toward a comfortable retirement. Retirement annuities provide invaluable aid for secure incomes during those golden years. Good preparation is key to its successful utilization.

Frequently Asked Questions

What is the best type of annuity for retirement income?

The best type of annuity for retirement income is an immediate fixed annuity, offering maximum guaranteed income for the cost and protection from market risk.

How much does a $ 100,000 annuity pay per month?

At the age of 65, if someone buys an annuity for $100,000, they will receive a payment each month immediately that is worth $614.

How much does a $ 200,000 annuity pay per month?

For a sum of $200,000 paid at age 65, an annuity would offer the purchaser monthly payments for life amounting to around $958.

How do fees and charges impact the overall value of a retirement annuity?

Retirement annuities can be negatively impacted by the fees and charges that build up over time, as this will ultimately reduce one’s potential earnings from it.

What are some common guarantees and riders available with annuities?

An annuity can provide increased financial security and flexibility with guarantees of lifetime income, safeguarding the principal amount and interest rate, as well as allowing for withdrawals, accumulations, a cost-of-living rider plus death benefit, and living benefits riders.

After 18 years as President and Founder of TheaterMania and OvationTix, Darren is excited to be on a new journey as the President and Co-Founder of The Institute of Financial Wellness. (The IFW)

For consumers, The IFW provides financial education, resources, and services that help people live their best life.

For Financial Professionals, The IFW provides proven sales and marketing systems, state-of-the-art technology, training, and support to financial professionals nationwide. The IFW helps financial professionals grow their practices to the next level! IFW Certified Financial Professionals are an elite group of professionals that, together with the IFW, help people succeed financially and live their best lives.