As you gracefully transition into the golden phase of retirement, a crucial question looms: have you planned for your largest retirement expense? Yes, we’re talking about healthcare costs – often the most significant yet underestimated financial aspect of retirement.

Did you know that healthcare costs in retirement will likely be your largest retirement expense? It’s true, and finding the right Medicare Advantage plan can be crucial in managing these costs. But with so many options, how do you choose the best one for your needs?

“When I was young, many people worked for a company with a pension plan that covered them for as long as they lived. If they didn’t have a pension plan, they could count on Social Security and Medicare.” – Robert Kiyosaki

We can help you understand the factors affecting health care costs in retirement the role of Medicare, and provide a step-by-step checklist for selecting the best Medicare Advantage plan.

Key Takeaways

- Healthcare costs are projected to rise significantly in the next decade, making it essential for retirees to evaluate Medicare Advantage plans.

- Medicare plays an important role in retirement planning and offers four parts that cover hospital and medical insurance, provide additional benefits, manage medication costs, and supplement Original Medicare.

- Strategies such as staying healthy, shopping around for services & taking advantage of HSAs can help reduce healthcare expenses during retirement.

Understanding Healthcare Costs in Retirement

To have sound protection during this time period in your life, plan thoroughly for Medicare, which is the national insurance program that assists individuals aged 65 years or older.

Having clear knowledge regarding different plans provided under Medicare can help you manage healthcare costs efficiently, thus allowing a smooth transition into retirement age.

Inflation and Healthcare Costs

As a stealthy enemy, inflation slowly depletes the value of savings. Not only that, but in other economic sectors, healthcare costs have risen annually above 3% [1]. Such an expense will most likely increase by up to 5.4% in the upcoming decade too, indicating why it is so important for individuals to look into their Medicare Advantage plans and find one that fits with personal needs perfectly.

Life Expectancy and Medical Needs

Living longer may be a blessing. It brings with it the increased costs of healthcare. Currently, in America, an individual has an average life expectancy of 76 years [2]. With that being said, proper planning for medical coverage must take place during retirement to tackle these rising healthcare expenses adequately.

Technological Advancements in Medicine

Modern medical technologies have provided an undeniable advantage to the quality of health care, diagnosis, and treatment. Unfortunately, these advances tend to come at a cost that is often too expensive for average individuals. For example, mRNA vaccines, artificial intelligence in data interpretation, and nanomedicine-based drug delivery are recent achievements that all heavily affect Medicare coverage. Ensuring those receiving such benefits receive up-to-date treatments with maximum effectiveness.

The Role of Medicare in Retirement

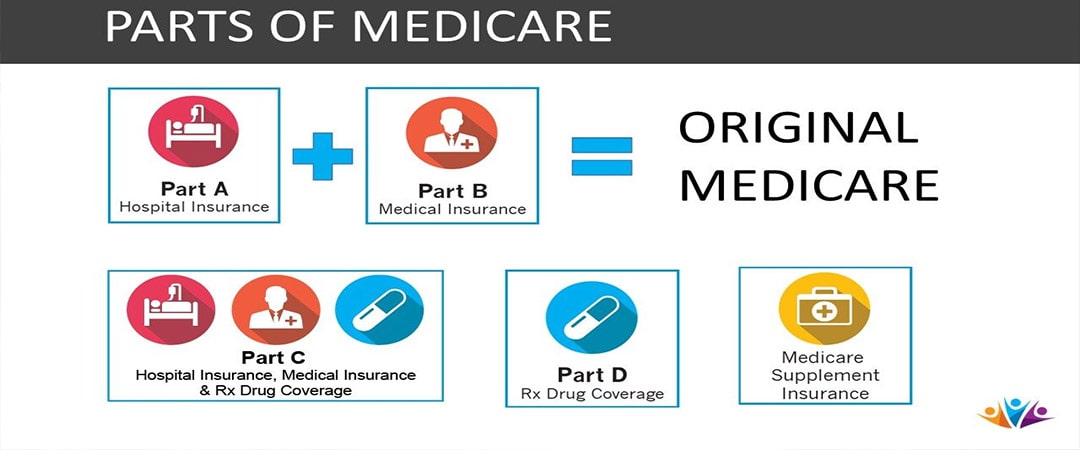

What role does Medicare play in retirement? The program consists of four elements: Original Medicare (Parts A and B) covers hospital stays as well as medical insurance, Part C brings additional advantages with an alternative to regular coverage known as Medicare Advantage, and Prescription Drug Coverage under Part D helps manage drug costs. While Medigap Insurance provides extra cover for any holes in standard Medicare policies.

Original Medicare (Part A & B)

Original Medicare, made up of Part A (hospital insurance) and Part B (medical insurance), covers inpatient treatment, skilled nursing facility care, as well as medical services. Most individuals don’t pay a premium for their Part A coverage.

They do need to fork out a monthly fee for the additional protection that comes with Part B—$174.70 per month, according to 2024 pricing records. Yet even though Original Medicare might not cover all healthcare requirements like prescription drugs, vision, or dental expenses, this is where most Medicare Advantage plans become useful by providing extra benefits such as additional coverage options beyond what Medicare provides alone [3].

Medicare Advantage (Part C)

Part C of Medicare, also known as a Medicare Advantage Plan, is an alternative to the Original plan. These are offered by private insurers and come with added benefits such as prescription drug coverage, dental vision care, and more – often resulting in lower out-of-pocket costs for retirees. To make sure you find the best option, it’s essential to compare plans based on their network of healthcare providers, along with the premiums and expenses involved.

Prescription Drug Coverage (Part D)

Prescription drug coverage (Part D), or a prescription drug plan, is an important factor in managing medication costs during retirement.

All medications in six protected classes, such as immunosuppressants and antidepressants, must be included in Part D plans. With Medicare Part D, there are monthly fees, deductibles, copayments, and other out-of-pocket expenditures to take into account, which can total around $33 per month, but it could also range from nothing up to almost two hundred dollars every 30 days if need be.

Enrollment into the program can happen through either Plan Finder on Medicare’s website or their phone number 1-800-MEDICARE (1-800-633-4227) – where assistance will happily assist you further.

Evaluating Medicare Advantage Plans for Retirees

Now that you have a firm comprehension of the various parts of Medicare, you can begin to examine which particular Medicare Advantage plan would be best suited for your retirement objectives. Think about such things as network providers, prices, and extra benefits while deliberating on this matter in order to make an educated decision regarding what kind of medicare advantage plans will work perfectly for you. Let’s take some time now and go into more detail regarding each point made just now.

How to Choose a Medicare Advantage Plan

When selecting a Medicare Advantage plan, one should take into account their individual requirements, preferences and budget and the differences between Medicare and private insurance.

Key points to look out for include the coverage of healthcare providers within the network provided by your chosen plan, premiums due monthly, copayments that may be required depending on usage, coinsurance that is dependent upon insurance costs based on healthcare services used in relation to other insurers, as well as any deductibles you would need before being eligible for certain benefits under the policy.

Network Providers and Accessibility

What else is important to know? When selecting a Medicare Advantage plan, the network of providers accessible and available is crucial in determining healthcare quality. With an expansive provider selection, you can opt for your preferred healthcare professionals or medical facilities to receive the care needed.

Cost Considerations and Out-of-Pocket Expenses

When evaluating Medicare Advantage plans, it is important to take into account both the plan’s premium and potential out-of-pocket expenses. These premiums range from $18 to $174.70 each month, so researching those pocket costs can help you choose which option provides the best healthcare value [4].

Additional Benefits and Services

Many Medicare Advantage plans provide coverage beyond what is offered by Original Medicare. This includes prescription drug benefits, dental care, vision services, and other fitness programs specifically tailored for older adults. It’s important to evaluate the different advantages of each plan when making a decision so that you are sure your retirement healthcare needs are sufficiently covered. To those already provided under original Medicare, it pays to investigate them! Did you know that Medicare can cover you if you’re on vacation?

Supplementing Medicare with Medigap Insurance

When it comes to Medicare coverage, there are two main options available -Medicare Advantage plans and Medicare supplement insurance (also known as Medigap). These additional policies sold by private insurers can help cover what Original Medicare does not cover – such as deductibles, copayments, and coinsurance.

To make an informed decision between the different types of Medigap plans offered, it’s important for people to compare them based on their benefits & premiums before signing up.

Medigap Plan Types and Coverage

Medicare’s Medigap Plan Benefits. Chart and other comparison charts can be used to compare the benefits of the ten distinct plans – labeled A-D, F, G, K-N, that provide varied coverage options. This allows you to determine which services each plan covers.

Comparing Medigap Policies and Premiums

When investigating Medigap policies and premiums, it is important to take into account multiple aspects, such as the insurance company providing the policy, the specific plan offered, and where you live. The cost of various plans can be calculated based on three pricing methods – community-rated, issue-age-rated, or attained-age-rated – so understanding those rating systems before making a comparison is vital.

To make sure that your needs are best met, thoroughly review all options available for choosing an ideal Medigap policy.

Planning for Long-Term Care Costs

Costs for this type of health service range from approximately $35,000 – $108,000 annually throughout the U.S. To help reduce and manage such expenses, there are multiple options like Long Term Care Insurance or Medicaid eligibility aid programs which provide access to resources that may prove beneficial financially [5].

Long-Term Care Insurance

When considering long-term care needs in retirement, it is important to determine if insurance is an appropriate choice. Typically, costs can range from $950 – $220 per year and vary due to age as well as the amount of coverage desired.

Medicaid Eligibility and Benefits

You should also be aware that health care coverage through Medicaid is available for people with low incomes and covers a range of services from doctor visits to preventive measures. Eligibility depends on financial information like income or assets, as it may vary between states.

These include hospital stays, prescribed medicines, psychological treatment, and all sorts of preventative treatments that fall under this program’s umbrella – so if you qualify for eligibility requirements, make sure not to miss out on getting those extra benefits!

Strategies for Saving on Health Care Costs in Retirement

To help lower the overall cost of medical care, here are some strategies to consider: utilizing preventive care for better health, shopping around to secure higher quality services and bargain prices, and taking advantage of Health Savings Accounts (HSAs).

Staying Healthy and Preventive Care

Achieving optimal health in retirement requires preventive care practices. Such services include screenings for diseases, immunizations, behavioral counseling interventions, and managing medications – all of which can help reduce the risk of chronic illnesses developing. Maintaining a healthy diet as well as participating in regular physical activity are two great ways that seniors can achieve good health during their later years.

Shopping Around for Medical Services

You can also try researching the options and comparing prices of procedures, medications, and other treatments; you will gain insight into which ones offer the best value while still providing quality care. Doing so puts you in an informed position when it comes to making healthcare decisions that won’t break your budget.

Utilizing Health Savings Accounts (HSAs)

HSAs provide a great financial benefit, with contributions to the account being tax-deductible and earnings within it staying untaxed. Qualified medical costs can be paid from an HSA without any extra taxation applied.

By investing in an HSA, you are taking advantage of these triple tax advantages: deductible contributions, deferral on profits earned, and exemption from taxes on withdrawals related to medical expenses.

Enrollment Periods and Avoiding Penalties

Understanding these timescales is essential if you are seeking out suitable health insurance options. Knowing when each period begins and ends can ensure that you have all the protection needed before any deadlines pass by.

“To keep the body in good health is a duty… otherwise, we shall not be able to keep our mind strong and clear.” – Buddha

Initial Enrollment Period

During the Initial Enrollment Period for Medicare – a seven-month window centered around your 65th birthday month, which includes those three months before and after it – enrollment is vital to avoid incurring late fees, such as extra monthly charges.

Open Enrollment Period

Every year, from October 15th through December 7th, is the Medicare Advantage Open Enrollment Period. This period of time gives you the opportunity to examine and adjust your Medicare coverage, such as signing up for a new Medicare Advantage plan or returning to Original Medicare instead.

Special Enrollment Periods

Medicare coverage can be modified or signed up for during a Special Enrollment Period outside the yearly Open Enrollment due to personal happenings like marriage, childbirth/adoption, divorce, and relocating. Such events provide an opportunity without facing fines to switch your medical plan depending on circumstances that have a certain time limit allotted.

The Institute of Financial Wellness: Financial Solutions for Retirees

The Institute of Financial Wellness is a multifaceted network offering financial education and services with the aim of improving an individual’s economic health. We have tools available that can be beneficial when it comes to reducing costs for healthcare in retirement, helping one properly plan their medical expenses, and getting the most out of benefits from said period.

It could be highly advantageous to utilize all resources provided by The Institute, which will strengthen cost management associated with healthcare during retirement and increase security while doing so.

Full Summary

The Institute of Financial Wellness is committed to helping you achieve a secure retirement. To do so, it’s important to understand the significance of healthcare costs and how Medicare Advantage plans can help manage them properly. Evaluating these policies should be an essential part of your planning process as they allow for more comprehensive coverage than standard Medicare does on its own and may even include Medigap or long-term care benefits that can assist in reducing expenses related to medical treatments.

Frequently Asked Questions

How much does the average person spend on healthcare in retirement?

A married couple aged 65 who is retiring this year can anticipate shelling out approximately $315,000 in medical expenses during their retirement [6].

How do retired people afford health care?

Retirees can take advantage of government-run programs such as Medicare to help cover the costs associated with healthcare, or contribute money into a Health Savings Account in order to prepare for expenses after turning 65. They could use funds from Roth and traditional IRAs along with long-term disability insurance payments in order to provide additional security against any medical bills that may arise.

How do I pay for medical expenses in retirement?

Retirees can finance their medical costs in retirement by taking advantage of a tax-free health savings account, using Medicare Parts A and B benefits, investing prior to 65 into an HSA fund, employing either Roth or traditional IRAs as part of their saving strategy, and procuring long-term care/disability insurance.

What improvements should be made to improve Medicare?

Medicare should be improved to provide comprehensive, easy-to-understand protection at an affordable cost. This would include adding dental care, hearing aids, and optical coverage for everyone on the program, increasing financial aid to low-income earners in order to reduce their outlay, as well as expanding it with access to long-term treatments.

What is the difference between Original Medicare and Medicare Advantage?

Medicare is a government-run health insurance program that provides both hospital and medical coverage, while Medicare Advantage is a private plan with an agreement from Medicare to offer supplementary benefits beyond what Original Medicare offers. Individuals enrolled in the latter are provided with more extensive coverage than those registered under original Medicare alone.