Pros of Planning Your Retirement Roadmap

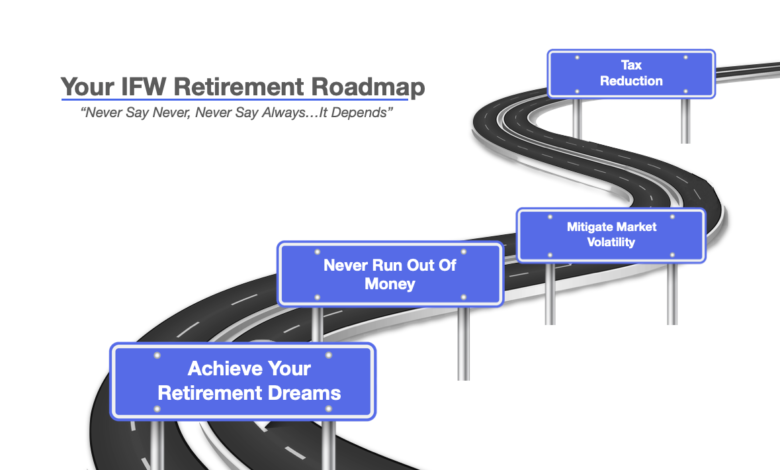

Retirement is an exciting time for those that are exiting the workforce and looking forward to spending quality time with their families and loved ones. However, like most things that are as rewarding as retirement, a good amount of planning is necessary to ensure its success. The Institute of Financial Wellbeing offers those that are thinking about or close to retirement plenty of great resources and information that detail the best way that you could start planning your retirement. One of the easiest ways to ensure a successful retirement is by creating a retirement guide or roadmap. Continue reading below to learn more about the best retirement planning strategies from the IFW.

Why Do I Need a Retirement Plan?

Retirement is a large milestone that often requires that you have everything in order for you to plan accordingly. Making a detailed plan reduces the chances that you are caught off guard by any roadblock that impedes your retirement. Efficient retirement planning answers any question marks that you may have while also filling in any gaps in your knowledge.

Also, creating retirement strategies reduces the stress that comes with planning your retirement, and managing your stress levels is extremely conducive to maintaining your health in the face of retirement. In fact, financial stress is related to conditions like diabetes, heart disease, migraines, and poor sleep. Having the peace of mind that comes with knowing that your retirement is going according to plan is priceless.

Lastly, planning your retirement with a retirement roadmap ensures that more money is going into your pocket and less is gone in taxes. Meeting with lawyers or other financial experts helps prospective retirees understand how to better manage their money so that their retirement is more enjoyable.

More On the Importance of Retirement Planning

Planning your retirement with a retirement roadmap makes it easier for you to contextualize your retirement with a big picture. This makes it easier for you to make important decisions related to your retirement and financial well-being. Whether it is helping with debt management or helping start your own business, paying for college, what kind of house you could afford, or other kinds of financial education, planning your retirement makes it easier for you to make these decisions.

Setting Up A Qualified Retirement Plan With The IFW

The Institute of Financial Wellbeing makes it easier for prospective retirees to effectively plan their retirement with our collection of resources and services. Planning the next stage of your life with our financial well-being webinar, titled Roadmap to Retirement, is easy. This is a webinar that teaches prospective retirees how to achieve their optimal retirement via cutting-edge tax reduction techniques, mitigating market volatility, and correct money management techniques.

If you would like to learn more about college savings solutions, 401k management, or other services, contact us today.

Additional Reading:

Insurance Calculator: Reach Your Health Savings Account Goal

Insurance Calculator: Save for Long Term Care

Insurance Calculator: Calculate Your Long Term Care Needs

###

Learn More About IFW’s Retirement Planning Education Services

The IFW provides valuable financial education, resources, and services that help people live their best life.

Please remember, be mindful of the messenger that positions certain products or services as “always” bad or “always” perfect. The fact of the matter is there are no “bad products” or “perfect products”. The right product is the one that aligns with your goals and objectives.

The Institute of Financial Wellness believes when it comes to financial decisions; never say “Never” never say “Always”…It Depends.

Evan Sussman is honored to serve as Senior Vice President for IFW. Evan has been a successful financial professional for over 17 years. On December 24th 2019, Evan was diagnosed with Stage 3 cancer, and is currently on the road to full recovery. He is forever indebted to the doctors, nurses, and staff that took care of him. Evan has dedicated his career to helping people secure their financial health and well-being.