Dedicated to helping you live your best life in retirement

We provide the knowledge, resources, and support to make the right financial decisions.

Our Mission

At The Institute of Financial Wellness (IFW), we believe financial education goes beyond numbers—it’s about helping people ‘Get There’ and live their best lives in retirement. Founded to provide clear, unbiased, fact-based financial guidance, IFW is America’s premier resource for engaging content, tailored solutions, and expert guidance to make the right financial decisions.

Our proprietary IFW Retirement Score furthers this mission, empowering everyone to achieve their best possible score and reach their retirement goals.

Our Value

A Fiduciary Standard

The Institute of Financial Wellness is a fiduciary registered with the U.S. Securities and Exchange Commission as an investment advisor.

Trusted & Top Rated

A+ Rated Better Business Bureau

Top Rated on Trustpilot

Featured Across Leading Media Networks

In The Media

Featured on leading media networks, sharing expert financial insights to educate and empower individuals on their path to financial security.

The IFW Process

Through our IFW Retirement Score, we guide you on a supportive journey tailored to your unique situation. After understanding your needs, an IFW concierge gathers key information, initiates your Retirement Score process, and connects you with the right financial professional to help chart a path that truly aligns with your goals.

Our Network

Our IFW Financial Professional Network is an essential part of what makes us unique. We carefully select independent financial professionals who align with our philosophy—understanding that “it depends” when it comes to financial planning. With extensive expertise and over 35 combined prestigious certifications, our professionals are ready to help you create a holistic, personalized plan that covers all aspects of financial well-being.

Additionally, the IFW is a registered fiduciary with the SEC.

Meet Our Leadership

Erik Sussman

Founder & CEO

Darren Sussman

Founder & President

Bella Scicluna

Head of Strategy & Marketing

Scott Rosen

VP of Advisor Services

Rees Bridges

VP Multimedia & Technology

Skylar Hargrove

Director of Operations

Thought Leaders and Advisory Board

David Adefeso

Investment Strategy & College Planning

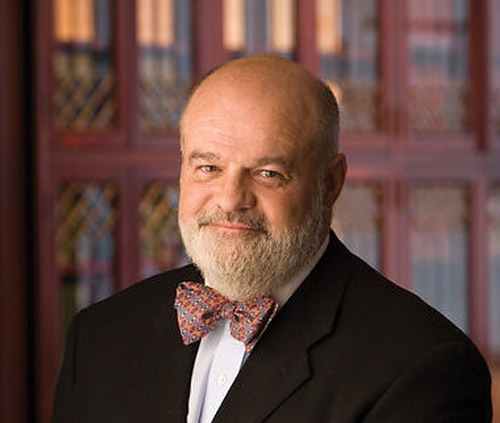

Tom Hegna

IFW Retirement Income Expert

David Schulman

Retirement Planning & Life Insurance Expert

Malik Yoba

IFW Arts & Entertainment Advocate & Educator

Fabrice Braunrot

IFW Financial Services, Health & Wellness Expert

Joe Jordan

IFW Financial Services & Consumer Education

Laurie Sallarulo

IFW Student Leader of Financial Education & Entrepreneurship

Kristin Chenoweth

IFW Arts Advocate, Actress, Singer, & Performer

Renee Haugerud

IFW Commodities Expert