“You are never too old to set another goal or to dream a new dream.” -C.S. Lewis

The retirement score and the credit score. What is really the difference?

Let’s discuss the significance of a credit score, a numerical indicator of your creditworthiness. It influences not just your capacity to obtain loans but also other areas, such as home rentals and more.

But let’s also take a look at the retirement score. A tool by the Institute of Financial Wellness to measure how ready you are for retirement.

Are you all set?

Key Takeaways

- Assess how ready you are for retirement. The IFW Retirement Score is a percentage-based metric that uses the Monte Carlo Simulation to assess financial readiness for retirement, similar to how a credit score measures creditworthiness.

- The credit score can affect financial opportunities. A credit score ranges from 300 to 850 and is derived from credit history factors such as the number of accounts, total debt levels, and repayment history, affecting loans or favorable interest rates.

- The primary difference between a credit score and a retirement score lies in their purposes. Credit scores evaluate creditworthiness based on past credit management, while retirement scores gauge the likelihood of achieving retirement income goals based on projected income, current savings, and anticipated expenses.

What is the IFW Retirement Score?

Unlock your retirement potential! The IFW Retirement Score is your go-to tool for checking how well you’re prepared for retirement.

Think of it like a credit score—it gives you a quick look at your financial readiness for your golden years. The higher your score, the better your chances of achieving your retirement dreams.

This score uses the Monte Carlo Simulation method, a trusted technique also used by NASA and many industries, to carefully analyze various factors and scenarios related to your retirement readiness.

Knowing your Retirement Score helps you pinpoint financial areas that need improvement. This can involve reducing taxes, protecting your investments from market ups and downs, or ensuring a steady income during retirement.

Much like regular health check-ups, you can not only review but also improve your retirement score, giving you confidence in your financial future.

What is a Credit Score?

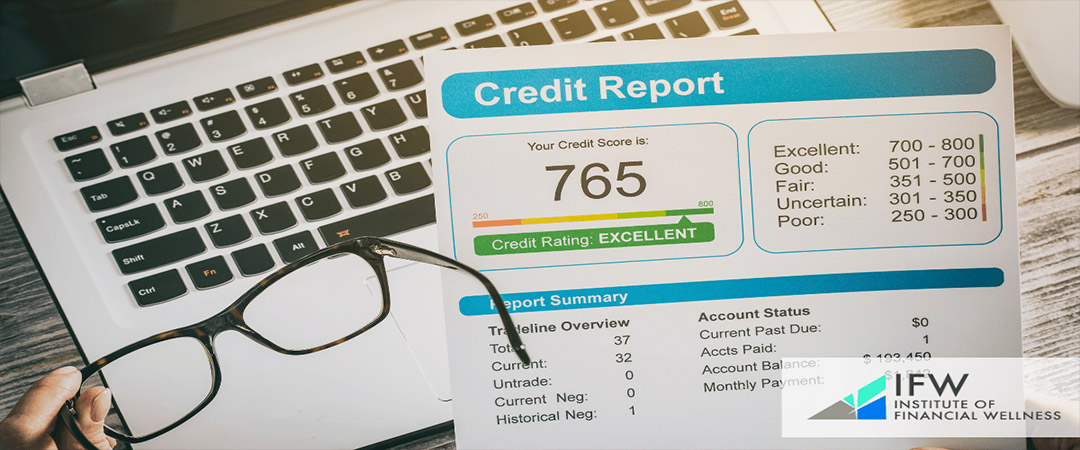

Your credit score is your key to financial freedom. It is a number, usually between 300 and 850, that shows how reliable you are as a borrower.

The higher your score, the better you’ve handled your debt, and the more likely you are to get good loan terms. This number is based on your credit history, including:

- The number of accounts you have

- Your total debt

- Your history of paying bills on time

This score reflects your past financial behavior and predicts how you might handle credit in the future.

In the U.S., three main agencies—Equifax, Experian, and TransUnion—collect and analyze your financial data. They gather detailed reports on your debt interactions, which lenders review when you apply for loans, rental housing, or even jobs.

A high score can make it easier and cheaper to get loans and other financial services.

Credit scores affect many areas of personal finance, such as getting home loans, rental agreements, job applications, credit card approvals, loan eligibility, and interest rates. Insurance rates can also be influenced by your credit score.

A high credit score offers significant benefits, providing financial flexibility and reducing the costs associated with debt. It’s important for people of all ages to understand and maintain a good credit score for overall financial health.

Credit Score vs. Retirement Income Score: What’s the Difference?

A credit score measures how likely you are to repay borrowed money on time, showing your trustworthiness as a borrower. An IFW Retirement Score, on the other hand, assesses how prepared you are financially for retirement, helping you plan for stability in your later years.

Credit scores are calculated by agencies, such as the ones mentioned above, and retirement scores are usually calculated by financial institutions and advisors using specific tools. The criteria for each score differ greatly.

Your credit score is influenced by factors such as payment history, length of credit history, debt-to-credit ratios, and the diversity of your credit types. Meanwhile, your retirement score considers projected income from various sources like savings and financial assets, needed income during retirement, and potential expenses like healthcare and market fluctuations.

Understanding the difference between these scores is crucial. A good credit score helps you secure loans and financing options easily.

A strong retirement score ensures you have enough resources to sustain yourself comfortably after you stop working. Managing both diligently ensures a high quality of life, covering all aspects of your financial health throughout your life.

Understanding the Importance of Your Credit Score in Retirement

Maintaining a high credit score is crucial even after you retire. It helps if you need to refinance your mortgage, start a new business, or get better insurance premiums.

A good credit score means you can secure low-interest loans for unexpected expenses like medical bills or home repairs.

If you plan to move to a retirement community or closer to family, a good credit rating is also beneficial. Even if you don’t plan on getting new loans, having a strong credit score gives you financial freedom and peace of mind.

It ensures you’re prepared for any financial opportunities or emergencies that might come your way in retirement.

How Retirement Affects Credit Scores

Transitioning into retirement can indirectly affect your credit score due to changes in income and spending habits. Retirement itself isn’t reported to credit agencies and doesn’t directly impact your score.

However, shifting from a regular paycheck to relying on savings, Social Security, or pensions can change your financial landscape.

If your monthly income decreases after retirement, your debt-to-income ratio might increase, which creditors consider when evaluating your creditworthiness. Relying on a fixed income could lead to higher use of your credit card balances, raising your credit utilization rate.

This can negatively impact your overall credit score.

By understanding these potential financial changes before retiring, you can develop strategies to maintain a healthy credit score and strong financial health throughout your retirement.

Keeping Your Credit Report Active

Is an active credit history important in retirement? Yes.

It is crucial to avoid falling into ‘credit retired’ status. Without regular credit transactions, your credit report could become inactive, making it challenging to obtain new credit when needed. Even a short period without activity, like six months, can cause your FICO score to become dormant.

To keep your credit report active:

- Choose a credit card that matches your spending habits.

- Pay off the full balance each month to avoid interest charges.

- Use your credit card for specific purchases, such as booking hotels, renting vehicles, or handling unexpected expenses.

Regular use and timely payments will help maintain your financial credibility and provide flexibility in managing your finances during retirement. This approach ensures you’re prepared for any financial needs that may arise.

Managing Credit Utilization Ratio

To maintain a strong credit score during retirement, it’s crucial to manage your credit utilization ratio carefully. This ratio compares the amount of credit you’re using to your total available credit limit and accounts for about 30% of your overall credit score.

Aim to keep this ratio low by maintaining low balances and using only a small portion of your available credit—ideally, no more than 30%.

Credit experts recommend keeping your credit utilization under 30% because those with excellent scores typically have an average utilization of around 6%. By consistently paying your bills on time and monitoring your credit card balances, you can protect your credit health while enjoying your retirement years.

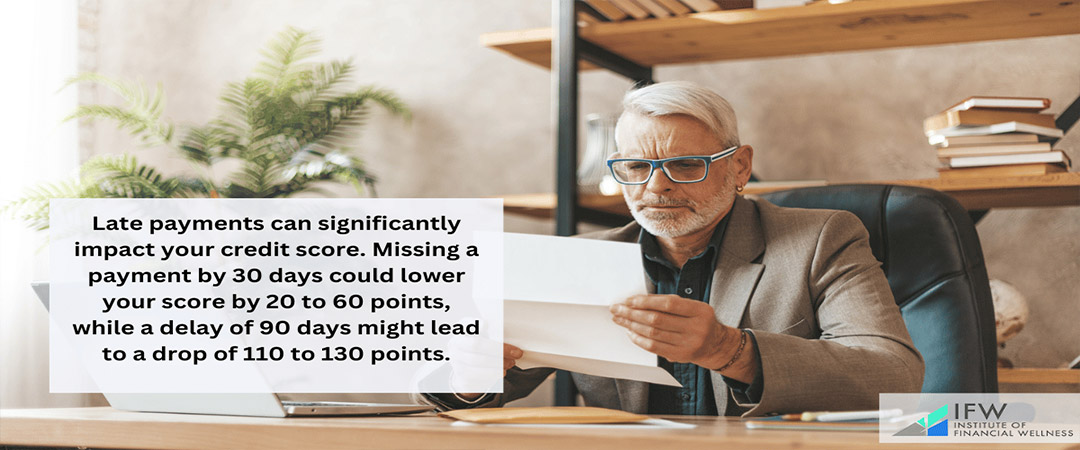

The Role of On-Time Payments

Is the FICO score important in retirement? Absolutely!

In retirement, keeping a high FICO score hinges greatly on your payment consistency, as your payment history makes up 35% of your score—the most crucial component. By paying bills promptly, whether for utilities, housing, or credit cards, you build a positive payment record that enhances your credit rating.

Late payments can significantly impact your credit score. Missing a payment by 30 days could lower your score by 20 to 60 points, while a delay of 90 days might lead to a drop of 110 to 130 points.

To avoid these consequences, consider setting up automatic payments to prevent accidental missed payments. This not only safeguards your financial reputation but also improves your chances of securing better interest rates on loans in the future.

Freeze Your Credit to Protect Against Identity Theft

In the battle against identity theft, especially during retirement, implementing a credit freeze is a powerful safeguard. Here’s how it helps:

- Blocks Access: It prevents most creditors and lenders from accessing your credit history, making it difficult for someone to open new accounts in your name.

- Complicates Unauthorized Accounts: It adds complexity for individuals trying to use your identity to get credit approvals.

- Prevents New Accounts: Even if thieves have your personal details, they can’t open new credit accounts.

To activate a credit freeze, you must contact all three major credit bureaus—Experian, TransUnion, and Equifax—and submit requests. Freezing your credit report is typically free of charge and remains in effect until you decide to lift it.

Staying vigilant and monitoring changes in your credit report can alert you early to any unauthorized activities. By taking these steps, including regular monitoring, you’re protecting your financial reputation and ensuring peace of mind throughout your retirement years.

Regularly Review Your Credit Reports

It’s crucial to monitor your credit reports regularly, especially during retirement, to maintain good credit health. Start by checking your credit report at least once a year using resources like annualcreditreport.com, which offers free access.

For enhanced security and early detection of errors or discrepancies, consider checking your report more frequently—perhaps every quarter. Staying informed allows you to:

- Identify and Challenge Errors: Spot inaccuracies that could harm your credit score and take steps to correct them promptly.

- Respond Quickly to Issues: Act swiftly to rectify mistakes or address unauthorized activities.

- Stay Informed About Changes: Monitor changes in your profile and receive alerts about new accounts opened under your name.

Many credit cards offer complimentary services for monitoring credit and protecting against identity theft. These features provide added protection, especially when managing charges on your card bill.

Taking advantage of these resources helps ensure your financial security throughout retirement.

Alternative Credit Data

For individuals with limited credit history, leveraging alternative credit data can be incredibly valuable. Those categorized as having “invisible” or “thin” credit files, or whose records may be outdated (“stale unscored”), can benefit from innovations in technology and financial services.

One effective method is incorporating rental payment histories into credit bureau reports. Certain platforms now allow these payments to contribute to your overall credit score, helping to build or enhance your credit profile.

Additionally, non-traditional sources such as utility payments from utility companies, banking transactions from bank accounts, and rent-related reporting from landlords can also be included. These strategies rejuvenate stale records and make individuals eligible for credit scoring, opening doors to better financial opportunities.

By embracing these alternative data sources, people can start building or improving their credit standings, paving the way for enhanced economic prospects.

Simplifying Finances for Better Management

To enhance the management of your good credit score and overall financial health during retirement, consider simplifying your financial landscape. Here’s how:

- Consolidate Accounts: Merge various financial accounts to reduce the number you need to monitor and maintain.

- Coordinate Asset Allocation: Ensure there’s a coordinated approach to how your assets are allocated.

- Adjust Investment Strategy: Align your investment strategy with your time horizon and risk tolerance.

These tactics streamline financial oversight, making it easier to stay vigilant throughout retirement. Implementing automatic payments is another effective method for ensuring bills are paid on time and managing cash flow efficiently.

Additionally, consolidating debts through personal loans can simplify debt management with a single payment schedule, improving the trackability of dues.

By decluttering your financial structure, maintaining a strong credit score becomes less burdensome, contributing to sustained economic security throughout retirement.

How Scams Target Retirees and How to Avoid Them

To maintain a strong credit score and overall financial health during retirement, consider simplifying your financial strategy:

- Consolidate Accounts: Merge multiple financial accounts to reduce the number you need to monitor.

- Coordinate Asset Allocation in Your Retirement Portfolio: Ensure your assets are allocated in a coordinated manner that aligns with your goals.

- Adjust Investment Strategy: Align your investment approach with your time horizon and risk tolerance.

These steps streamline financial oversight, making it easier to stay vigilant. Implementing automatic payments ensures bills are paid on time and helps manage cash flow efficiently.

Consolidating debts through personal loans can simplify payments into a single schedule, improving debt management.

By simplifying your financial structure, you can maintain a strong credit score and achieve sustained economic security throughout retirement.

The Impact of Retirement Income on Credit

Transitioning into retirement can indirectly affect your credit scores, primarily due to changes in income sources. Moving from regular employment earnings to income from Social Security, pensions, and retirement savings may increase your debt-to-income (DTI) ratio.

A higher DTI ratio can potentially reduce your ability to secure loans with favorable terms.

After retirement, relying more on credit cards can also impact your credit utilization ratio, a critical factor in your credit score. Retirees should manage their credit utilization by maintaining lower balances and ensuring they have sufficient available credit.

This practice promotes fiscal stability, which is essential for maintaining good credit health.

To support this stability, it’s advisable to consistently deposit funds into savings accounts to keep them adequately funded. This approach not only strengthens financial security but also contributes to sustaining a strong credit score throughout retirement.

Leveraging Retirement Accounts Wisely

Consolidating and leveraging your retirement accounts can provide several benefits, including:

- Streamlining financial management

- Enhancing tax efficiency

- Better assessing and syncing future income streams with cash flow needs

- Simplifying the computation of Required Minimum Distributions (RMDs) to ensure compliance with tax laws

Financial advisors can help with the following:

- Navigating the complexities of tax laws

- Identifying optimal tax treatments for your investments, potentially reducing tax liabilities and penalties

- Mixing tax-advantaged and non-tax-advantaged accounts to enhance tax efficiency and simplify tax reporting through their advisory or brokerage services

Leveraging these strategies ensures that your retirement savings are managed effectively, supporting a comfortable and financially secure retirement.

Planning for Unexpected Expenses

Planning for unexpected costs is crucial in retirement, where the absence of regular income can leave finances vulnerable to emergencies. Medical crises and family matters, common during retirement, highlight the need to allocate funds specifically for such situations.

Establishing an emergency fund involves setting up automated transfers from your retirement savings distributions into a separate savings account. Regularly review and replenish this fund after withdrawals to ensure readiness against unforeseen financial demands.

These proactive measures safeguard financial well-being in retirement and protect savings from being depleted by unexpected expenses.

Advisory Services for Financial Guidance

Financial advisors play a crucial role in retirement planning and financial management, creating personalized strategies that align with your goals and risk tolerance. They offer a comprehensive view of your finances, assisting with investments, debt management, and preparing for expenses like healthcare and inflation.

Establishing an ongoing partnership with a financial advisor offers several benefits:

- Enhanced Financial Understanding: Gain a clearer understanding of your financial needs and goals.

- Tailored Recommendations: Receive customized advice that fits your unique circumstances.

- Cost Savings: Benefit from streamlined processes and scale advantages that may reduce fees.

- Steady Guidance: Navigate market volatility with steady guidance focused on long-term prosperity rather than reacting to short-term market fluctuations.

By working closely with a financial advisor, you can better navigate the complexities of retirement planning and ensure your financial well-being throughout your retirement years.

Striving for Retirement Success: The Comprehensive Approach of the Institute of Financial Wellness

The Institute of Financial Wellness (IFW) is dedicated to helping people reach their monetary goals and enjoy an optimal lifestyle by offering a wealth of financial education and services. We present a diverse array of dynamic educational materials, such as on-demand videos, webinars like our Retirement Score Webinar, and e-newsletters that delve into numerous subjects ranging from investment strategies to retirement planning.

Key among IFW’s offerings is the Retirement Roadmap, which equips those approaching retirement or already retired with tools to stave off concerns about depleting their funds and shield their nest egg from market fluctuations as well as unwarranted taxes. The IFW Financial Check-up delivers crucial insights for managing budgets effectively, ensuring individuals can have peace of mind regarding their fiscal well-being.

In alignment with personal requirements, IFW connects clients with skilled financial experts who provide continued assistance and customized solutions for enduring prosperity.

Full Summary

To effectively plan for your financial future, it is critical to comprehend the distinction between your retirement score and credit score. Your readiness for retirement is indicated by the former, whereas the latter assesses how trustworthy you are with credit and has an effect on many financial decisions even as you retire.

You can maintain a high level of financial freedom and security in retirement by adopting strategies such as regular review of credit reports, ensuring payments are made punctually, and managing your utilization of credit.

Judicious use of retirement accounts coupled with preparation for unforeseeable costs and seeking advice from expert financial counselors can help secure a relaxed and stable post-work life. Organizations like the Institute of Financial Wellness offer resources that aid in navigating through fiscal matters confidently toward realizing cherished goals during one’s golden years.

Frequently Asked Questions

What is the IFW Retirement Score?

Using Monte Carlo Simulation, the IFW Retirement Score provides a percentage-based evaluation of your potential to achieve income objectives throughout your retirement.

This score serves as an indicator that estimates the probability of fulfilling financial targets for one’s later years.

How does retirement affect my credit score?

The act of retiring in itself does not have a direct effect on your credit score. Alterations in income and expenditure patterns as a result of retirement can influence factors such as your debt-to-income ratio and the amount of credit you utilize, which may indirectly alter your score.

It’s important to monitor your fiscal practices diligently to preserve an optimal credit score during retirement.

Does credit score vary according to a person’s income level?

Yes, credit scores vary by income level:

- Low-income families have a median credit score of 658.

- Moderate-income families: 692

- Middle-income families: 735

- High-income families: 774 [1].

Why is it important to maintain a good credit score during retirement?

It’s essential to maintain a good credit score even in retirement, as it aids in coping with unforeseen costs, attaining advantageous terms on loans, and preserving financial adaptability.

What are some common scams targeting retirees?

Retirees must remain vigilant against scams such as false representation by government officials, deceitful lottery wins, and counterfeit tech support by being skeptical of unexpected communications and consistently keeping an eye on their credit reports.

What is the average credit score in the US?

As of February 2023, the average credit score in the U.S. is 714. This score reflects the overall credit health of consumers [2].

How can I leverage my retirement accounts effectively?

By consolidating your retirement accounts, you can simplify financial oversight and improve tax efficiency as part of managing your retirement funds effectively.

It may be beneficial to enlist the assistance of a financial advisor who can guide you through tax regulations and help fine-tune investment tactics for optimal performance.

Is there a difference between men’s and women’s credit scores?

Men and women exhibit nearly identical credit scores, with men averaging 705 and women averaging 704. Both groups experienced a 10-point increase between 2015 and 2020 [3].