As you come closer to retirement, RMDs (Minimum Required Distributions) and their effect on your financial stability may be ringing alarm bells in your mind. Waking up on an early Tuesday morning to worry about your financial future in retirement is no way to live.

Are you ready to get an in-depth look at the intricacies of minimum required distributions and strategies for minimizing taxes while managing multiple accounts? With this knowledge, you’ll have the confidence necessary to make informed decisions about planning for a comfortable retirement.

Plus, check out our Ultimate Tax Planning Checklist for a step-by-step guide to proper tax planning.

Key Takeaways

- Understanding RMDs is essential for retirement planning, as they are mandatory annual withdrawals from tax-deferred accounts starting at age 73.

- RMDs are critical to ensure taxes on retirement savings are paid and that the funds are used as intended. Calculations can be done using IRS tables or a calculator provided by Investor.gov or financial advisors such as the Institute of Financial Wellness.

- Failure to take an RMD may result in penalties, so it’s important to understand key deadlines and strategies such as Roth IRA conversions and QLACs, which can help minimize the tax burden of RMDs when managing multiple accounts

Understanding Minimum Required Distribution (RMDs)

Let’s begin at, well, the beginning. Starting December 31, 2022, the Secure Act has amended Required Minimum Distributions (RMDs) rules by raising their age from 72 to 73 [1].

RMDs are compulsory yearly withdrawals of tax-deferred retirement account funds such as traditional IRAs and 401(k). They aid in avoiding taxation on those savings which build up over time.

What is an RMD?

Retirement plans, excluding Roth IRAs, must have a minimum amount withdrawn annually once an individual reaches the age of 73. This is known as Required Minimum Distributions (RMDs). The first RMD should be taken by April 1st after turning 73 and will depend on life expectancy according to guidance from the Internal Revenue Service (IRS) along with current account balance.

Importance of RMDs

RMDs ensure that retirement accounts are utilized for their intended purpose while at the same time providing tax revenue to the government. By mandating account holders to remove a set amount from their savings, these rules discourage them from postponing taxes on those assets indefinitely.

RMD Calculation for 2023

For 2023, the age for when individuals must begin taking their RMDs has been increased to 73 instead of 72. This guide will provide an overview of how to correctly compute your required distributions using IRS tables, with examples included in order to help better understand the process. Accurately calculating one’s RMD is essential as it can have a large impact on financial decisions and avoid possible penalties.

How Do I Calculate My Required Minimum Distribution?

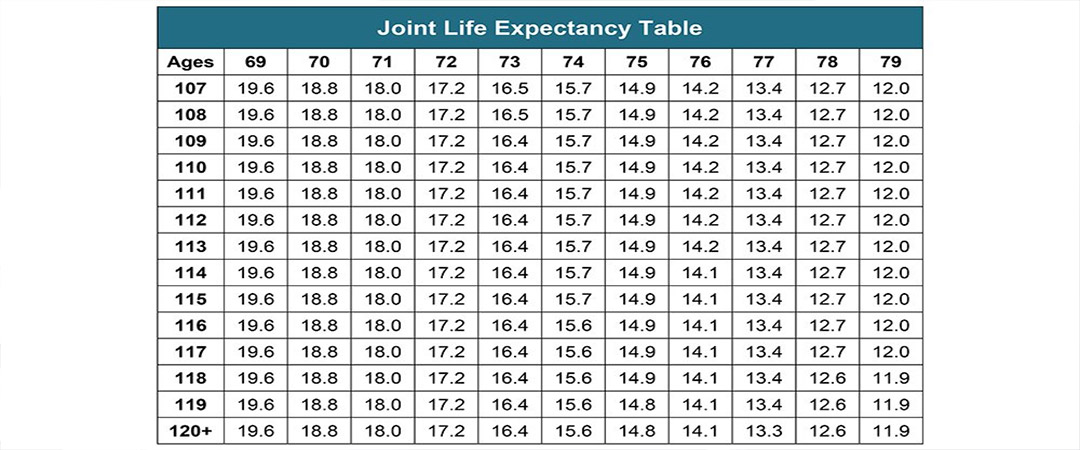

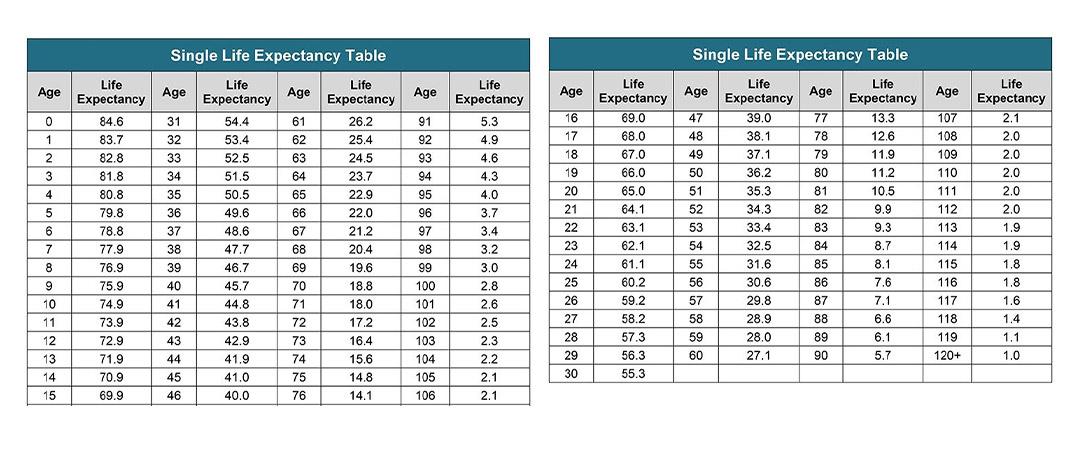

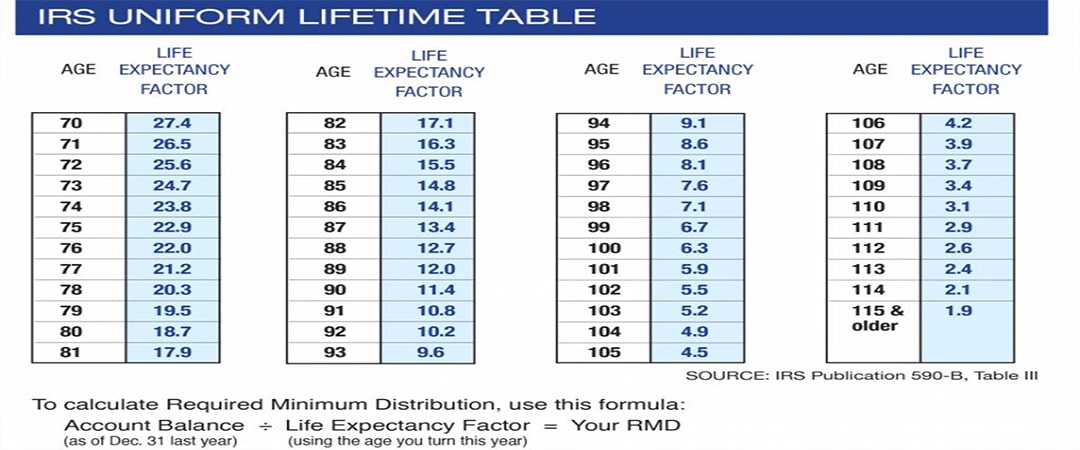

To calculate your required minimum distribution (RMD), you’ll need to utilize a life expectancy table, which takes into account factors such as age and account balance.

This will provide you with a designated distribution period, which is then used to divide your total account balance in order for you to get an accurate calculation of your RMD. A useful tool that can be employed here is calculator services like those provided by Investor.gov or The Institute of Financial Wellness. These make it easier and more precise when calculating minimum distributions from retirement accounts.

Using IRS Tables

To accurately calculate the RMD amount, IRS tables are employed to establish the distribution period. These include:

Joint and Last Survivor Table II

Single Life Expectancy Table I

Uniform Lifetime Table III

All of which enable you to identify your relevant distribution timeline based on the life expectancy factor as well as age.

Calculation Examples

For a better understanding of RMD calculations, let’s look at two examples.

EXAMPLE: The first case has an age of 73 with a balance on their traditional IRA account equalling $100,000 and using the IRS Uniform Lifetime Table to determine the distribution period. In that case, it would be 25.6, so the RMD calculation for this individual will come down to $3 906.25 ($100 000/25.6).

If there are multiple retirement accounts involved, then each one needs its own separate calculation for respective distributions from all accounts combined – don’t forget to consult your financial advisor if you want tailored advice specific to your situation!

RMD Deadlines and Penalties

Knowledge of the timelines and penalties connected to Required Minimum Distributions (RMDs) is critical for proper supervision of retirement accounts, helping avoid potential financial repercussions. Let’s explore key dates, what you may face when being fined, plus variables that need consideration in selecting either annual or monthly RMD withdrawals.

Key Deadlines

The initial RMD must be taken by April 1 of the year after you turn 73. All other subsequent withdrawals need to occur before December 31st on an annual basis in order for them not to incur penalties. Keeping track of this is essential since it guarantees that the correct amounts are withdrawn promptly and accurately.

Penalty Consequences

Missing the deadline for a Required Minimum Distribution may result in a significant tax penalty of 25% imposed on the RMD amount not taken out [2]. It is possible that an IRS waiver could be granted if action is taken to make up for it within two years.

Contacting a professional tax advisor can help you understand how best to handle this situation and any applicable repercussions.

Is It Better To Take RMD Monthly or Annually?

Taking them monthly can offer a more consistent income, which is helpful in covering regular expenses like living costs. Alternatively, opting for annual distributions may result in one bigger payment that can be put towards major purchases or investments.

Advantages of Monthly RMDs:

- Steady Income Stream: Monthly distributions can mimic a paycheck, providing a regular income stream. This can be useful if you rely on your RMDs for monthly expenses.

- Market Volatility: Spreading withdrawals throughout the year can help reduce the impact of market volatility on your RMD amounts, similar to a dollar-cost averaging strategy.

- Tax Withholding: If you need to have taxes withheld from your RMD, taking monthly distributions can spread out the tax impact.

Advantages of Annual RMDs:

- Maximize Growth Potential: By delaying your RMD to the end of the year, your retirement account has more time to potentially grow tax-deferred.

- Simplicity: One annual withdrawal is administratively simpler and easier to manage than 12 monthly withdrawals.

- Tax Planning: An annual RMD can be more easily coordinated with other tax planning strategies.

Other Considerations:

- Cash Flow Needs: Assess your monthly expenses and cash flow needs. If you have other reliable income sources, you may prefer an annual RMD.

- Market Conditions: If the market is performing well early in the year, you might consider taking your RMD sooner. Conversely, if the market starts the year poorly, you might delay in hopes of a recovery.

- Tax Bracket: Consider your expected annual income and how RMDs might impact your tax bracket. If taking an RMD might push you into a higher tax bracket, you may opt for monthly withdrawals to even out the taxable income.

- Investment Strategy: Some might prefer monthly RMDs to rebalance their portfolio steadily, while others might do this on an annual basis.

RMD Rules for Different Retirement Accounts

The RMD rules that determine how to withdraw from a retirement account vary according to its type. Traditional IRAs, 401(k)s, Roth IRAs, and inherited accounts are all governed by specific regulations in this regard.

To improve understanding of these requirements, it is important to take into consideration each particular kind of savings vehicle when making withdrawals. Knowing the differences between them can be beneficial for extracting money while still retaining tax benefits under certain conditions as well as adhering to laws applicable at any given time.

Traditional IRAs and 401(k)s

Once reaching a certain age based on life expectancy and account balance, individuals with either traditional IRAs or 401(k)s must abide by RMD rules, which involve the withdrawal of minimum distributions annually starting at 73 years old. It is strongly recommended to seek guidance from IRS regulations or an experienced financial advisor in order for accurate information regarding the specific requirements for your account type.

Roth IRAs

Roth IRAs provide a special advantage when it pertains to RMDs due to the fact that during an account holder’s lifetime, there is no required minimum distribution. If you are inheriting a Roth IRA, then you must abide by certain RMD rules for beneficiaries. The chance of tax-free growth and withdrawals that come with using Roth IRAs makes them quite attractive in terms of minimizing taxation-related costs from retirement savings.

Inherited Accounts

When it comes to RMD rules for inherited accounts, the specifics depend on who is receiving the account and when the original account owner passed away. Speaking, if they are not a spouse of theirs, then distributions will be required from their inheritance. Who receives those distributions (e.g., sole beneficiary) and how much needs to be taken out will vary according to the age at the death of said individual. Thus, it is always wise to double-check with both IRS regulations as well as an experienced financial advisor before taking any action relating to such funds or decisions surrounding them.

Strategies to Minimize RMD Tax Impact

Tax planning strategies are helpful when trying to minimize the impact of RMDs. Two such options that may prove beneficial include Roth IRA conversions and Qualified Longevity Annuity Contracts (QLAC).

Roth IRA Conversions

It is possible to lessen the tax burden of RMDs by converting a traditional IRA or 401(k) into a Roth IRA. With this approach, you are paying taxes on the converted amount immediately rather than at retirement when withdrawing from funds. Due to no lifetime required minimum distributions for Roth IRAs, it can be an efficient way of managing savings and reducing taxation accordingly.

A financial advisor should be consulted if considering whether or not conversion into a Roth IRA is suitable for one’s particular circumstances.

QLACs (Qualified Longevity Annuity Contracts)

Investing in a QLAC can help minimize the RMD tax burden. A financial planner is the best way to evaluate if this annuity option, which provides guaranteed income over a set period of time and reduces taxable retirement income, is right for you. To assess your needs accordingly, it’s recommended that you speak with an expert so they can provide advice tailored to your specific situation.

Navigating RMDs with Multiple Accounts

When it comes to managing multiple retirement accounts, the RMD process can be complicated. In this section, we will explore how one would go about consolidating similar account types and strategically handle individual 401(k)s or 457(b)s as they pertain to their RMD obligations.

Aggregating RMDs

Account holders have the flexibility to combine their total RMD amount from multiple IRAs or 403(b) contracts. This allows for a simplified management of Required Minimum Distributions (RMDs) and enables account holders to choose which accounts they wish to withdraw from. When aggregating, it is still necessary that each account’s individual RMD be calculated before combining them together.

Separate RMDs for 401(k)s and 457(b)s

When it comes to managing multiple retirement plans, organization is key. 401(k) and 457(b) accounts cannot be combined like IRAs or 403 (b). As a result, you will have to calculate the RMD for each plan individually, not together. It’s recommended that you consult with an experienced financial advisor if needed to ensure all requirements are properly met in regard to these types of retirement plans.

Institute of Financial Wellness

The Institute of Financial Wellness is a source dedicated to offering financial education, advice and resources that can help people manage their money more effectively. Their goal is for individuals to make sound decisions with respect to their finances so they are able to reach the desired outcome: A secure retirement income or savings plan.

This platform has specialized guidance on how one should handle RMDs (Required Minimum Distributions) as well as other topics connected with getting ready for retirement – all in order to maximize your assets set aside when it comes time to leave work life behind.

Full Summary

In summary, managing Required Minimum Distributions (RMDs) is a vital part of preparing for retirement. To ensure that you are properly set up financially in your later years, it is important to be aware of the rules and timelines surrounding RMDs, do calculations correctly so as not to incur tax penalties, and use effective strategies that minimize their impact on taxes. Taking these steps will help secure an improved financial future. As always, though, one should seek advice from a professional when making decisions about how best to handle RMDs given individual circumstances; there are organizations like The Institute of Financial Wellness who can lend support, too!

Frequently Asked Questions

How do I calculate my required minimum distribution?

To calculate your required minimum distribution, you can use the life expectancy factor provided by the IRS in their Publication 590-B to divide your account balance as of December 31 from the previous year. For example, if an individual aged 73 has a $100,000 IRA account balance that was recorded on December 31 last year. Dividing this amount with 26.5 (the given life expectancy factor) would result in them having an RMD value of $3,773.58.

Do you have to take RMD at age 72 or 73?

If you turn 72 in 2023, the SECURE 2.0 Act has raised your Required Minimum Distribution (RMD) age to 73. This means that your first RMD must be taken by April 1st of the year after reaching this milestone.

How much do you have to withdraw from your 401k at age 72?

Once you reach the age of 72, according to IRS regulations, a portion of your 401(k) must be withdrawn using your RMD worksheet. This calculation is based on dividing your current balance by a number between 25.6 and 1.9.

How do I calculate my required minimum distribution table?

To find out your required minimum distribution amount, divide the total balance of your retirement account at year-end by the number of years left in your life expectancy as specified under the IRS’s Uniform Lifetime Table.

Can I aggregate RMDs from multiple retirement accounts?

You can take aggregate Required Minimum Distributions (RMDs) from several retirement accounts, including IRAs and 403(b), but a separate RMD must be taken for each 401(k) or 457(b).