“Don’t simply retire from something; have something to retire to.” – Harry Emerson Fosdick

What’s the best 401k for teachers strategy? It’s not that complicated! Find out how to optimize your retirement savings with our straightforward insights tailored to educators and learn about the advantages, comparisons to pensions, and steps for maximizing your 401k contributions here. Buckle up for this ride by maximizing savings.

The Institute of Financial Wellness teaches you how to get there with the Retirement Roadmap Experience!

Key Takeaways

- 401(k) plans offer teachers significant tax advantages, such as pre-tax contributions and tax-deferred growth, with the option for Roth 401(k)s allowing tax-free retirement withdrawals.

- Teachers must navigate between different retirement plans, such as the 401(k), 403(b), and pension systems, taking into consideration factors like eligibility, employer matching contributions, and investment options.

- Diversifying retirement savings through various accounts such as IRAs, Roth IRAs, and 457(b) plans can enhance a teacher’s financial security, complemented by the educational resources provided by institutions like the Institute of Financial Wellness.

Teacher Appreciation Week: Empowering Educators

During National Teacher Appreciation Week, we take a moment to celebrate the profound impact educators have on our children’s lives. This special week, anchored between May 6th and 10th, is an opportunity to recognize the hard work and dedication of teachers everywhere. But beyond the well-deserved praise, it’s also a critical time to reflect on the financial future of our educators. How do teacher pensions stack up against other retirement options like 401(k)s or IRAs? What advantages do these plans offer public school teachers who have dedicated their lives to this noble profession?

For teachers, the quest for a secure retirement is more than a mere consideration—it’s a vital part of the appreciation they truly deserve. The example set by educators in shaping our future leaders should be met with an equal commitment to ensuring their financial well-being. As we delve into retirement savings, remember that the dedication you show in the classroom can be equally applied to planning for your financial future. Let’s embark on this journey with the same passion you bring to teaching.

Understanding 401(k) for Teachers

Delving into retirement plans can be as complex as creating a curriculum for students with varied needs. For educators, grasping the essentials of the employer-sponsored 401(k) is critical for ensuring a stable financial future post-retirement. These accounts facilitate setting aside part of your earnings and are often sweetened by matching contributions from employers, enhancing the growth of your retirement savings significantly. But why should teachers consider incorporating a 401(k) into their retirement strategy when weighed against teacher pensions and other pension schemes?

The advantages come down to an advantageous blend of tax benefits, ceilings on contributions, and potential boosts from employer matches that serve as foundational elements in these pension accounts. Contributing to your 401(k) goes beyond just saving money. It’s about laying down an essential layer upon which you will build reliable retirement income vital to your long-term fiscal well-being. To better appreciate its worth, let’s explore it. How favorable tax treatment and supplemental deposits made by employers render a 401(k) an appealing component within one’s overall plan for retiring comfortably.

Tax Advantages of 401(k) Plans

As an educator, you understand the importance of advanced preparation. This principle is equally important for your financial well-being, especially when considering the tax advantages associated with a 401(k) plan. Important benefits include:

- Contributions made to your retirement account are pre-tax, which reduces your current taxable income and acts as a form of tax-deferred annuity.

- Essentially, this allows you to take advantage of immediate tax relief while simultaneously setting aside funds for the future.

- The gains from investments within your 401(k) accumulate without incurring taxes until you decide to draw on these funds upon retirement.

Opting for designated Roth contributions presents another strategic option through the Roth 401(k), also known as a designated Roth account. Although it lacks an initial tax break because contributions are made post-tax, one key benefit lies in being able to make withdrawals during retirement that are entirely free from federal taxes—this includes all earnings accrued over time. Imagine having access to a source of retirement income that remains completely exempt from taxation! Such an approach offers greater flexibility within your overall retirement strategy and can lead to increased disposable income during those golden years of life after work. Ask The Institute of Financial Wellness financial advisors about how you can take maximum advantage of your retirement savings as a teacher.

Contribution Limits and Employer Match

Grasping the fundamentals of how to enhance your retirement account is crucial for a robust financial future. The annual limits on contributions define the ceiling for how much you can put into a 401(k) each year, and in 2024, teachers are allowed to contribute up to $23,000—a slight increase from the limit set in the previous year [1]. If an employer match is available with your plan, it can greatly magnify what you’ve saved by potentially doubling your personal contribution amount. This benefit shouldn’t be overlooked as it essentially equates to receiving complimentary money toward your retirement goals.

Consider every paycheck as a sapling planted within the nourishing confines of your retirement savings account. Think of employer matching as vital sunlight and rain encouraging its growth. Together, employee and employer combined contributions may soar up to $69,000 annually—this substantial sum could massively transform one’s financial landscape come retirement time [2]. Whether embarking on saving or optimizing current efforts towards amassing funds in your account, leveraging understanding around employer matches is akin to cultivating an adeptness at one’s fiscal reserves.

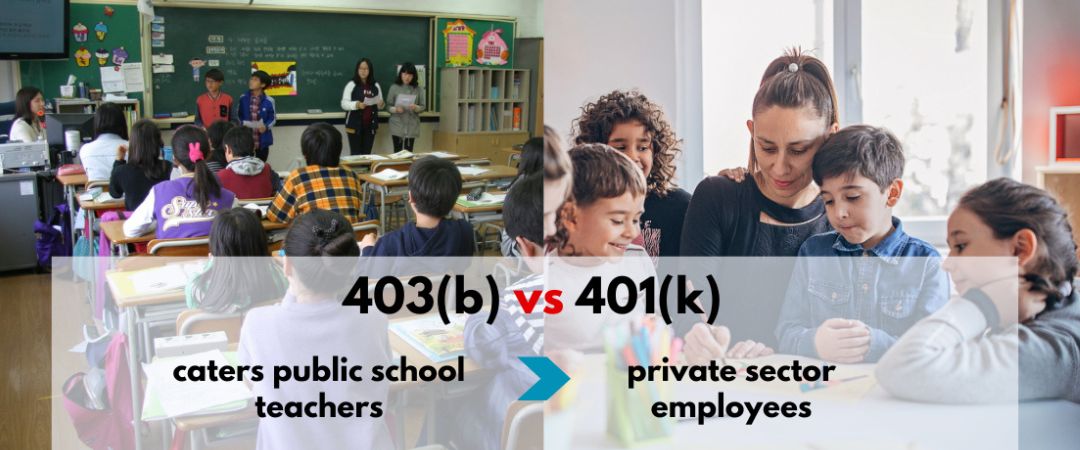

Comparing 403(b) and 401(k) Plans for Teachers

When examining the landscape of financial planning, it’s important to distinguish between 403(b) and 401(k) retirement plans. While they appear similar on the surface, each plan is uniquely crafted to meet the needs of different groups of educators. The 403(b) plan caters specifically to public school teachers working in the public sector, while private sector employees are typically offered a more diverse array of investment options through a 401(k).

Consider a 403(b) as an exclusive tool kit for those educated in public schools and a 401(k) as an expansive set for professionals employed by private or tax-exempt organizations. Both types allow for catch-up contributions if you’re behind on your retirement savings and impose specific contribution limits. Teachers need to examine these differences closely—considering both eligibility criteria and available investments—to carefully sculpt their ideal retirement strategy that aligns with their unique financial aspirations.

Eligibility for Teachers

While charting the course for your retirement, it’s crucial to grasp which individuals are permitted to take part in these retirement plans. 403(b) plans stand as a prevalent option among public school teachers and according to regulations, they must be accessible to all qualified employees unless certain exceptions apply. Ineligibility may arise if you’re already enrolled in an alternative qualified plan or if your weekly work hours don’t exceed 20.

Conversely, should your school district offer both a 401(k) and a 403(b), typically you’d have to decide between contributing to one of these accounts – not both. Circumstances do exist where educators might contribute simultaneously to each type of account while staying within established contribution limits. Opting for either or potentially combining contributions into both accounts requires careful contemplation of regulatory guidelines against the backdrop of one’s personal financial situation.

Ultimately, selecting the appropriate scheme is about aligning with what suits your vision for post-work life and adheres well with the particulars of your tenure as a teacher.

Investment Options in 401(k) and 403(b) Plans

For educators employed in public schools, retirement planning is offered through various accounts with a range of investment choices similar to the diversity found in an educational environment. The 403(b) plans available to teachers often emphasize annuities and mutual funds as their primary investment vehicles, offering a more focused approach for those seeking straightforward options. Conversely, those opting for a 401(k) can benefit from an expansive selection that includes stocks and bonds, among other securities, allowing investors to align their portfolio with personal risk preferences and financial aspirations.

As someone dedicated to education, you recognize the necessity of individualizing instruction just like investments should be tailored according to one’s retirement goals. Whether your preference leans towards the dependability provided by mutual funds or you have an inclination toward the dynamic potential presented by varying securities, these avenues serve as foundational elements designed for enhancing your long-term fiscal stability. Committing yourself to carefully nurturing your own retirement finances mirrors how diligently you cultivate knowledge within each student. It’s about selecting optimal strategies that will sculpt an equally rewarding post-career life.

Teacher Pensions and Social Security Benefits

Retirement plans for educators are anchored not only by 401(k) and 403(b) accounts but also by teacher pensions, which provide a crucial source of lifetime income for those who have served in public schools. The breadth of pension benefits varies across different states, yet they all aim to ensure that teachers receive a consistent flow of income during their retirement years, complementing the funds accumulated from other retirement savings vehicles. It’s important for teachers to keep an eye on the fiscal health of their pension systems though. Shortfalls in funding may necessitate higher contributions or could result in diminished benefits.

Teachers who transition into private sector jobs might also qualify for Social Security benefits if they’ve completed at least ten years of work to earn sufficient credits. As individuals navigate through various career stages, these social security entitlements can significantly contribute either as a mainstay or an addition to one’s overall plan for retirement income. Thoughtfully integrating pensions and social security with additional avenues of saving is critical when constructing robust financial securities tailored for your post-career life.

The Importance of Diversifying Retirement Income

The composition of retirement income ought to be as multifaceted as a comprehensive educational syllabus, incorporating multiple sources to buffer against the unpredictability inherent in financial markets. Although pensions offer some stability, relying on them alone may leave you wanting to meet your full retirement objectives. Enriching this with an assortment of personal investments, Social Security benefits, and additional retirement accounts like the 457(b) or Roth IRA can solidify your fiscal foundations and ensure readiness for any contingencies.

Take the 457(b), which presents yet another option for amassing savings that supplement existing retirement funds. The Roth IRA stands out due to its tax benefits and absence of mandatory withdrawals at certain ages—key features that grant more flexibility and control over one’s finances. When you diversify your assets this way, it is akin to creating meticulous lesson plans—not just for educating students but also for devising a comprehensive strategy so each segment of your retirement life remains stable and gratifying.

Ultimately, it boils down to employing your money with diligence comparable to the effort invested throughout your career. Constructing strong pillars on which rests a future ripe with potentialities alongside tranquility during the twilight years.

Strategies for Optimizing Your 401(k) Plan

As you prepare for retirement, think of it as a subject that you’ve been gearing up to lecture on over the years. Beginning early with your 401(k), embracing catch-up contributions as retirement looms closer, and acquiring tailored professional guidance are crucial steps for achieving top marks in retirement preparedness. Imagine your 401(k) like a curriculum that needs ongoing adjustments to reach its educational goals—your monetary objectives. The choices between a 401(k) and a 403(b), along with optimal investment selections, represent key decisions toward securing an outstanding grade in managing your retirement plan. Your financial advisor at The Institute of Financial Wellness can help.

Teachers can enhance their 401(k) approach by drawing upon resources from educator associations and state pension plans, which provide targeted advice relevant to each state’s context—a bit like attending specialized training aimed at improving one’s financial savvy so that their retirement strategy is just as robust as their academic lesson planning. If executed correctly, these tactics ensure your 401(k) functions effectively, driving you toward a future rich with potential while safeguarding against economic worry during those golden years of life after work.

Catch-Up Contributions

Catch-up contributions serve as an advantageous addition for educators nearing retirement, presenting those 50 and over with the opportunity to deposit extra funds into their retirement savings accounts. These additional contributions are particularly impactful for teachers who may have begun saving at a later stage or whose careers were marked by pauses. The contribution limits established for these catch-up efforts allow eligible individuals to add an extra $7,500 beyond the usual contribution caps [3].

Designed to boost retirement preparations, catch-up contributions stand as evidence that fortifying one’s economic position can happen at any age. They offer a crucial chance for educators to make up for periods when they couldn’t contribute substantially—ensuring that upon concluding their teaching tenure, they transition into their post-work life with ample financial security.

Choosing the Right Investments

Navigating the selection of investment options for your 401(k) can be as intricate as assessing a pile of academic essays, yet it doesn’t need to be overwhelmingly complex. The crux is to match your investments with your aspirations for retirement, considering how much risk you’re comfortable taking and the time left until you retire. Your 401(k) offers a diverse portfolio that may include stocks, bonds, and mutual funds—each adaptable to meet your personal financial story—and investment companies provide access to these tools so that you can fulfill those future financial needs.

While contemplating the wide array of choices in investments for retirement savings, consider engaging with financial advisors whose expertise is comparable to teacher-student mentorship. They have the capacity to guide through an extensive range of possibilities, ensuring that whichever investments are chosen are optimally positioned for growth in preparation for retirement. Equipped with a solid plan tailored by expert advice on investment strategies like those you can find at The Institute of Financial Wellness, you will have confidence similar to when stepping into classroom instruction heading towards this significant phase in life.

Alternatives to 401(k) Plans for Teachers

Teachers have access to various retirement savings plans beyond the standard 401(k), including IRAs and Roth IRAs. These investment options may provide advantages like reduced fees, more diverse investment choices, and extra tax benefits, complementing employer-sponsored programs nicely.

Those educators who are either contributing the maximum allowable amount annually or possess a higher family income can find these alternative accounts especially advantageous. Setting up an objective for retirement savings — such as dedicating 10% of your income toward it — and engaging with several types of accounts allows you to craft a detailed financial strategy that will pay off during your retirement years. The aim is to construct an investment portfolio that mirrors the same level of care and commitment exemplified in one’s teaching career.

IRAs and Roth IRAs

The Internal Revenue Service-endorsed individual retirement arrangements like IRAs and Roth IRAs can act as superb supplements to your 401(k) or 403(b) accounts, providing additional layers of fiscal benefits. Take the Roth IRA. For instance, its key advantage lies in allowing tax-free withdrawals during retirement—a boon that grows in value if you ascend into a higher tax bracket that might otherwise diminish your take-home income. These plans aren’t subject to required minimum distributions, giving you the liberty to accumulate savings indefinitely and secure financial independence befitting an educator’s aspirations. It is imperative, though, to keep abreast with IRS rules while leveraging these advantages to maintain adherence to prevailing tax laws.

In contrast,

- Traditional IRAs provide immediate tax deductions for contributions—an attractive feature when facing high current taxes

- They allow access to a broad spectrum of investment options which may incur lower fees compared with those linked with employer-sponsored programs

- Ultimately, they promise increased accessible funds upon retirement so one can enjoy post-working years reminiscent of blissful school breaks enjoyed throughout a teaching tenure.

Defined Contribution Plans like 457(b)

Retirement plans such as the 457(b) provide an important avenue for teachers to prepare for their golden years. These defined contribution plans bear resemblances to both the 401(k) and 403(b), but they also offer unique characteristics that may be advantageous. One notable aspect is that educators over 50 have the option of making additional catch-up contributions, enhancing their ability to boost retirement savings in a manner consistent with other types of retirement accounts.

One key advantage of the 457(b) plan lies in its withdrawal terms. In contrast to other employer-sponsored retirement plans, it allows individuals who sever employment ties to take distributions without facing penalties commonly associated with early withdrawals from similar accounts. This feature lends considerable flexibility and can relieve financial concerns for teachers considering retiring earlier than usual or shifting careers, helping them better manage life’s uncertainties and career path changes with less financial stress.

Empowering Educators: The Institute of Financial Wellness

The Institute of Financial Wellness (IFW) is an oasis in the often arid landscape of financial planning. It stands as a beacon for teachers seeking comprehensive financial education and resources. With a mission to help individuals “Get There” and live their best lives, IFW delivers objective financial education content that engages and informs. From weekly live financial education webinars, like our Retirement Roadmap Webinar, to an array of on-demand video content, the institute ensures that teachers have the tools they need to make informed financial decisions.

Moreover, IFW’s network of financial professionals, including those from an insurance company, and tailored services, like the IFW Retirement Score and the IFW Financial Check-up, offer personalized guidance and support. These resources are invaluable for teachers crafting their retirement strategies, providing clarity and confidence every step of the way.

In a profession dedicated to lifelong learning, IFW serves as a vital resource for teachers to ensure their financial well-being is as well-tended as their intellectual pursuits.

Full Summary

The path to fiscal security is complex and highly individualized. The process involves delving into the details of 401(k) plans with their tax benefits, weighing these against the features of 403(b) plans, and evaluating other savings options like IRAs and 457(b) plans. As different as each teacher’s approach in guiding students through learning experiences, so too are the choices for saving toward retirement. It’s important to embark on this journey early on, diversify your investment portfolio, and obtain specialized advice that aligns with your personal financial story.

Consider this guide a beacon as you chart your course through various retirement possibilities with assurance and strategic thinking. While shaping young minds continues to be at the forefront of your endeavors, remember also to commit yourself wholeheartedly towards securing a robust future post-career life similar in importance to any curriculum taught in classrooms. With careful planning supported by proper resources at hand, envisioning a time replete with grand new ventures or peaceful relaxation becomes more than attainable—it beckons from beyond today’s achievements invitingly towards tomorrow’s promise-filled horizon.

Frequently Asked Questions

What are the main benefits of contributing to a 401(k) plan as a teacher?

As a teacher, making contributions to a 401(k) plan can provide you with the benefit of tax-deferred growth and possibly even matching funds from your employer. You have tax benefits like contributing on a pre-tax basis or choosing Roth 401(k) options for withdrawals that are free of tax.

How do teacher pensions compare to 401(k) or 403(b) plans?

Retirement income for teachers is ensured through pensions, which offer a fixed payout. Conversely, the value derived from 401(k) and 403(b) plans depends on the amount of contributions made and how those investments perform over time.

Are there any special contribution options for teachers nearing retirement?

Certainly, teachers who are 50 years old or older have the option to enhance their retirement savings by making catch-up contributions. These additional amounts surpass the regular contribution limits for retirement accounts and serve as a means for educators nearing retirement to potentially increase their future financial security.

Can teachers participate in a 403(b) and a 457(b) plan at the same time?

Indeed, if their employer offers both options, teachers are eligible to take part in a 403(b) as well as a 457(b) plan while observing the prescribed contribution limits.

What resources are available to help teachers plan for retirement?

Educators can tap into a wealth of resources, like the Institute of Financial Wellness, and also consult with financial experts as well as associations specific to educators for advice tailored to their state when preparing for retirement.

These offerings include fiscal education materials, interactive webinars, individualized services, and recommendations that are pertinent to the particular regulations and conditions within each state.