Navigating the intricacies of retirement withdrawal strategies is a critical part of planning for your golden years. Brace yourself, and let’s discuss various approaches to maximize tax-free income, take into account relevant taxation implications, and help you hone in on an effective financial plan that leads to both stress-free and secure retirement!

Key Takeaways

- Understanding different retirement withdrawal strategies is key to developing a comprehensive plan.

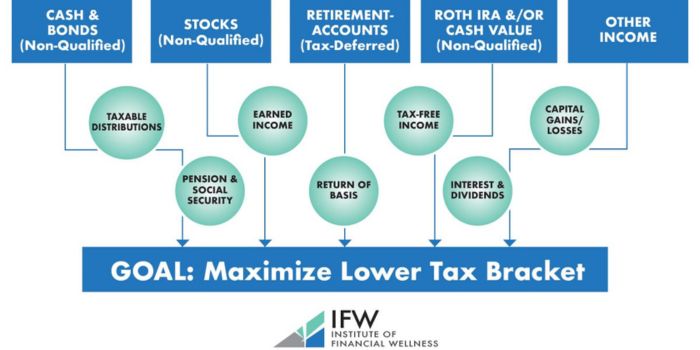

- Strategies such as proportional withdrawals, capital gains management, and investment can help generate income and manage taxes.

- Working with a financial professional can provide guidance in creating an individualized strategy that meets your needs.

Understanding Different Retirement Withdrawal Strategies

Retirement accounts such as 401(k) and IRAs provide multiple withdrawal options that can be adjusted to fit an individual’s financial situation. To ensure a comfortable retirement, it is important for retirees to have knowledge of these strategies in order to get the most out of their savings while avoiding penalties on taxable income. Popular methods include the 4% rule, bucket strategy, and dynamic withdrawals, each providing unique benefits depending on your needs. With careful planning, you will also be able to maximize tax deductions when withdrawing funds from different sources in your retirement account portfolio so that you may receive steady income during those years after working life comes its conclusion.

401(k)

When it comes to 401(k) withdrawal strategies, two of the most popular approaches are fixed-percentage withdrawals and systematic withdrawals. Fixed-dollar deposits involve taking out an identical amount each year for a pre-decided period. Thus offering predictable income in your first retirement year based on your budget needs. This approach offers convenience as one does not have to constantly adjust their withdrawal amounts during inflationary times.

On the flip side, though, setting this dollar value too high can lead you to drain away all of your retirement savings when pulling money out – something which is less likely with other options like fixed percentage or systematical withdrawals.

IRA

When developing withdrawal strategies for retirement, one must consider required minimum distributions (RMDs), Roth IRA conversions, and charitable giving. Through a conversion of funds from a traditional 401(k) or an IRA to a Roth, the tax liability can be addressed in advance by paying income taxes on those savings during the transfer year. Allowing them to benefit from future withdrawals without incurring any tax charges as well as passing wealth onto their beneficiaries.

Making donations directly through IRAs is another effective way of managing taxable income during retirement since these contributions do not count towards income, resulting in no extra liabilities being incurred upon filing your return statements.

How to Pick The Right Retirement Account Withdrawal Method

Retirement withdrawal is a complex process, and selecting the right retirement account for your specific circumstances requires considering multiple factors. Taxes, life expectancy, and additional income sources must be considered, as well as the composition of one’s investment portfolio. There are various options available, such as 401(k)s or IRAs, when it comes to designing an effective plan that will ensure a secure financial future after retirement age has been reached.

Required minimum distributions also need to be taken into account in order to meet IRS regulations while Roth IRA conversions can minimize taxes due at any given point down the line since no tax deductions apply from these accounts upon withdrawals being made during later years in someone’s life cycle. Proportional strategies work towards lessening risk exposure, whilst Capital Gains Management helps retain substantial wealth over time.

Lastly, taking advantage of Social Security benefits may provide additional resources during golden years if properly handled by both parties involved with this kind of arrangement – client included + financial professional who aids along its success journey path ahead – highlighting all important facts associated thereto till completion thereof accordingly seen henceforth too!

Navigating Tax-Deferred Retirement Accounts

Retirement accounts, such as 401k plans and IRAs that are tax-deferred, have specific rules regarding withdrawals. When money is taken from these types of accounts, it will count towards the recipient’s taxable income. When individuals turn 72 or 73 years old, they must begin taking minimum distributions (also known as RMDs). Ignoring this requirement could lead to an excessive penalty equal to half of what should have been withdrawn initially. Understanding how taxes work with various kinds of investments can reduce liabilities while staying compliant and keeping away any possibilities where you might owe taxes in the future.

Required Minimum Distributions

RMDs (Required Minimum Distributions) are obligatory payments from conventional 401k and IRA accounts that have to be made once an individual reaches the age of 72 or 73. This initial withdrawal must take place by April 1 in the following year after their start date. The amount taken out is calculated using a person’s estimated life expectancy, which comes through dividing the account balance with the help of IRS estimations. Those who neglect this activity can face a hefty punishment. 50% penalty on the unwithdrawn sum due according to IRM regulations. To avoid any fines, one should understand RMD rules completely while making such withdrawals punctually for greater compliance with these laws set forth by the Internal Revenue Service (IRS).

Roth IRA Conversions

Converting retirement savings from a 401(k) or traditional IRA to a Roth IRA can provide tax-free future withdrawals and transfers for beneficiaries. Before making such an important decision, it is vital to understand the risks involved, like taxes on converted amounts as well as increased Social Security benefits taxation. It is recommended that anyone considering such a conversion consults with their financial professional in order to assess if this option would fit into their current financial situation appropriately.

Maximizing Tax-Free Retirement Income

In order to attain a content and secure retirement, it is important to maximize your tax-free income. Various strategies, such as regulated withdrawals from retirement funds in proportion to capital gains, can help reduce the taxes owed while also ensuring that one’s savings are lasting throughout their years of retirement.

Proportional Retirement Withdrawal Strategies

With a retirement withdrawal strategy based on proportionality, it is possible to withdraw from both taxable and Roth accounts at the same time. This creates more stability in taxes annually while also extending the life of your nest egg for retirement.

Deferring money taken out of traditional as well as Roth options may lead to positive outcomes such as leaving investments untouched in tax-advantaged plans longer, which can lessen Social Security benefits and Medicare premiums, ultimately granting you higher overall income when retiring.

Capital Gains Management

Capital gains management can be useful for those looking to take advantage of lower tax brackets in retirement and help reduce their overall taxes. To maximize post-tax returns, investing with a long-term mindset coupled with utilizing tax-advantaged retirement accounts is recommended. Alongside this, capital losses may offset any profits from gains, as well as employing efficient investment strategies that are tailored towards one’s particular goals and needs when it comes to achieving income during the retirement years. Ultimately, these practices have been proven to improve not only the amount saved but also increase total earnings over time for an improved standard of living upon reaching full retirement age.

Generating Retirement Income through Investment Strategies

For a secure retirement, it is essential to have reliable sources of ordinary income via investment approaches. Possibilities include collecting interest and dividends from investment accounts, redeeming maturing bonds or CDs as well as liquidating extra resources when needed.

Adding low-risk options like CDs and high-yield savings into your portfolio are additional ways to support the fund in retirement years. Establishing diversified strategies for investing helps attain steady earnings during these times while providing long-term fiscal security throughout one’s lifetime post-career life.

Balancing Social Security Benefits with Retirement Savings

Maximizing Social Security benefits can play a big part in ensuring financial stability for retirement years. Here are some ways to achieve that: first, by working 35 or more years and earning a higher salary. Second, delaying receiving the benefit until age 70. Lastly, incorporating tax strategies that will help reduce taxes while optimizing income. These methods, if implemented correctly, allow retirees to balance their security with other savings, thus creating an overall comfortable retirement plan with an adequate income stream, including social security payments. It is essential to properly manage both these aspects of pension funds so as to attain the desired level of contentment when it comes to retirement finances and well-being.

Adjusting Your Withdrawal Strategy Based on Market Conditions

To safeguard your retirement savings and maintain them for the entirety of your golden years, adjusting a withdrawal strategy according to various market conditions is highly recommended. Techniques like the total return approach, dynamic withdrawals, bucket strategy as well as spending rules provide you with flexibility in dealing with such changing circumstances.

When strategizing for financial stability later on in life, it’s essential to consider factors including taxes and lifespan expectancy alongside other sources of income, which will ensure a relaxed lifestyle ahead. Selecting an appropriate way of withdrawing money from retirement accounts can make certain that those assets are still there upon reaching old age. All this combined should guarantee one’s economic security during their time after retiring. Making necessary changes while keeping these ideas intact when possible makes all the difference depending on several external elements outside our control but playing into the desired outcome over a longer period of time.

Working with a Financial Professional

Retirement withdrawal strategies should be tailored to each individual’s financial situation, and working with a knowledgeable financial professional can provide the expertise required for making informed decisions. It is important to research a potential advisor’s credentials, such as the Certified Financial Planner (CFP) designation, and confirm their background via FINRA before engaging in any collaboration. Comparisons of fees associated with services rendered by different advisors help ensure that you are getting optimal value from your money spent on retirement withdrawals.

Institute of Financial Wellness

The Institute of Financial Wellness is a multi-media platform offering financial education, resources, and services with an emphasis on retirement planning. It presents helpful guidance to assist people in making informed decisions regarding their journey towards financial freedom by retiring early.

Resources from the Institute can help increase your knowledge about various withdrawal strategies as well as select the most suitable method for withdrawing funds from your retirement account, all aiming at maximizing tax-free income during this period. It aids you in adjusting your strategy depending on market conditions when necessary.

Full Summary

To ensure a secure retirement for yourself and your family, it is essential to be knowledgeable of various withdrawal strategies, use tax-deferred accounts effectively, obtain maximum benefits from tax-free income sources, and adjust the withdrawal plan in response to market conditions. It would be wise to seek help from experienced financial professionals as well as utilize resources such as those offered by The Institute of Financial Wellness. With proper preparation through careful planning, you can enjoy a more comfortable lifestyle during your retired years.

Frequently Asked Questions

What is the best way to withdraw money for retirement?

The best way to withdraw money for retirement is to start with investment income, delay withdrawing from 401(k)s and IRAs until required minimum distributions kick in, and don’t tap into Roth accounts until exhausting other options. Common withdrawal strategies include the 4% rule, the bucket strategy, and dynamic withdrawals. Taxes, life expectancy, and your investment portfolio should also be taken into consideration.

Lastly, it can be helpful to prioritize withdrawals from taxable accounts first, followed by tax-deferred accounts, and then tax-free accounts last.

How do I avoid 20% tax on my 401k withdrawal?

One way to avoid a 20% tax on 401(k) withdrawals is by transferring the funds into an individual retirement account or another workplace plan through rollover. Delaying Social Security payments and setting up IRAs can assist in decreasing taxes owed from any retirement income.

Is it better to withdraw monthly or annually from 401k?

It is suggested to take out withdrawals from your 401k periodically instead of one single withdrawal per annum. This approach will provide an even distribution throughout the stock market fluctuations while also allowing for long-term appreciation in its value.

What are some popular retirement withdrawal strategies?

When it comes to retirement withdrawals, there are a few common approaches that can be taken. The 4% rule, bucket strategy, and dynamic withdrawal methods all prove popular among those entering their retirement years.

What is the difference between a traditional IRA and a Roth IRA?

Contributions to a traditional IRA grow tax-deferred, while with the Roth IRA option, both growth and withdrawals in retirement are completely tax-free. This makes it an appealing choice for those seeking freedom from taxes in their later years of life.